Venture capital deal-making shoots up in Q1; one in three VC deals was for over $10M

Venture capital dealflow has seen a marked increase with both number of startups getting VC money and rising valuations pushing up the quantum of money flowing into the companies, as per early data collated by VCCEdge, the data research platform of VCCircle.

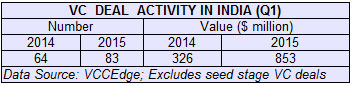

VC firms, which do pre-Series A to later stage investments, inked 83 transactions with an aggregate announced investment value of $853 million in the first quarter of 2015. This translates into big jump with quantum of VC money rising more than 2.5x over Q1 2014 and number of deals also rocketing in the same period.

To be fair, the rise in value is partly skewed due to a clutch of four $50 million plus deals involving e-com marketplace ShopClues, which raised $100 million in Series D round from Tiger Global, Nexus Venture Partners and Helion Venture Partners; besides mobile recharge venture Freecharge ($80 million), Singapore-headquartered Big Data firm Antuit ($56 million) and auto portal CarDekho ($50 million).

However, these deals do not drive the big picture.

What's significant is that as many as one in three VC deals (excluding seed funding transactions) in India last quarter involved investments of $10 million or more. Last year in the same period just one in ten such VC deals were in the over $10 million range. This shows the maturing startup ecosystem in India.

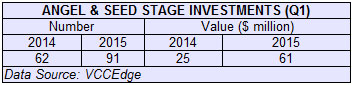

What adds to the buzz in the early-stage investment activity is the spike in angel and seed investments. This rose almost 50 per cent to 91 deals with the aggregate investment amount more than doubling to $61 million.

These investments are critical for the VC firms as this expands the list of startups who get early backing to scale up and join the pool of firms who become possible investment opportunity for VC firms in the future.

(Edited by Joby Puthuparampil Johnson)