PhonePe takes issue with Paytm's claims of UPI dominance

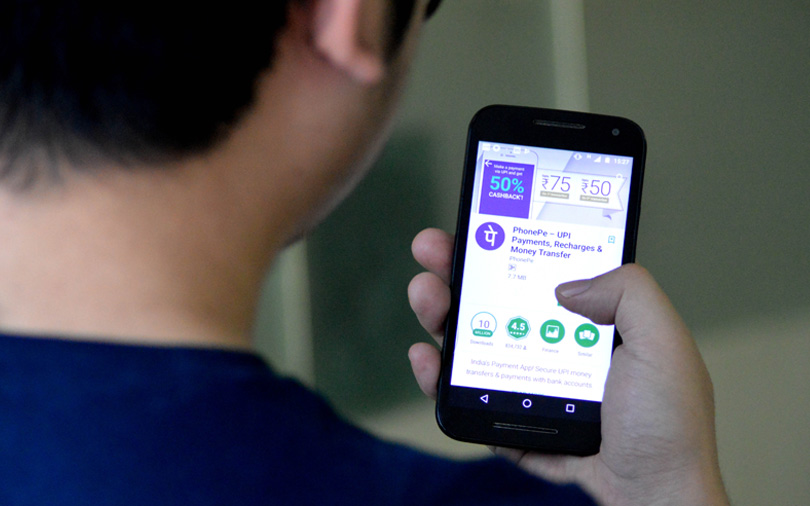

PhonePe, the payments app of e-commerce firm Flipkart, has termed digital payments firm Paytm’s claim of being the largest player on Unified Payments Interface (UPI) as “uni-dimensional and misleading”.

Observing the UPI February data relating to money transfers from Paytm to PhonePe, and not all of the rival’s statistics because of unavailability, Flipkart’s firm found Paytm’s average transactions per customer to be very high. The figure stood at 525, much higher than PhonePe’s five. It attributed the Paytm number to cashback incentives which “appeal to a very small population”, pointing out that the average transaction value on the rival was only Rs 38, much less than PhonePe’s Rs 1,820.

PhonePe’s higher average transaction value may largely be attributed to the large-ticket purchases on parent Flipkart’s ecommerce platform.

UPI is a government-backed payment system that allows electronic money transfer.

Flipkart payment app PhonePe accepted that Paytm leads in transaction volumes on UPI, with a 40% share, but the metric does not reveal the true picture.

To reveal a more holistic picture, PhonePe said it found out Paytm’s average transaction value and average transactions per customer using data on UPI money transfers from Paytm to PhonePe in the month of February.

The data, PhonePe said, relate to the 21 million transactions out of Paytm’s total 68 million that were money transfers by Paytm customers to PhonePe clients in February.

Using the data, PhonePe found “just 40,000 unique consumers” in February on Paytm. This, it said, contrasts PhonePe’s 6,000,000 unique customers in the period. (Unique customers refer to the number of distinct individuals during a given period, regardless of how often they visit the app or website.)

For February, UPI’s overall average transaction value was Rs 1,116. According to the data available with PhonePe, the number stands at Rs 38 for Paytm, “which further corroborates these (transactions) are all cashback-triggered”, the Flipkart app said.

According to data released by National Payments Corporation of India (NPCI), Paytm accounted for 68 million of the 171.4 million UPI transactions reported for February while PhonePe registered 28 million.

PhonePe argued that NPCI should publish unique customer count to provide a more holistic picture of digital payments ecosystem.

The fresh controversy erupts just weeks after Paytm’s founder Vijay Shekhar Sharma triggered a major online storm by implying that NPCI had bent the rules to suit Facebook-owned WhatsApp, which recently launched a beta version of its UPI-based payments feature.

NPCI later said WhatsApp will have to abide by all guidelines before it rolls out the final version of its payments feature.