Fintech bags most funding deals in April even as Tiger Global lights up agritech

In April, the Indian startup ecosystem again witnessed a flurry of deals with cheque sizes ranging from angel to seed to growth stage even as gaming company Dream11 joined the bandwagon of unicorns.

In a sign of renewed enthusiasm for the Indian market, New York-based Tiger Global Management made a comeback after more than three years. Hedge fund and venture investor Tiger Global is best known for its early bet on homegrown e-commerce player Flipkart.

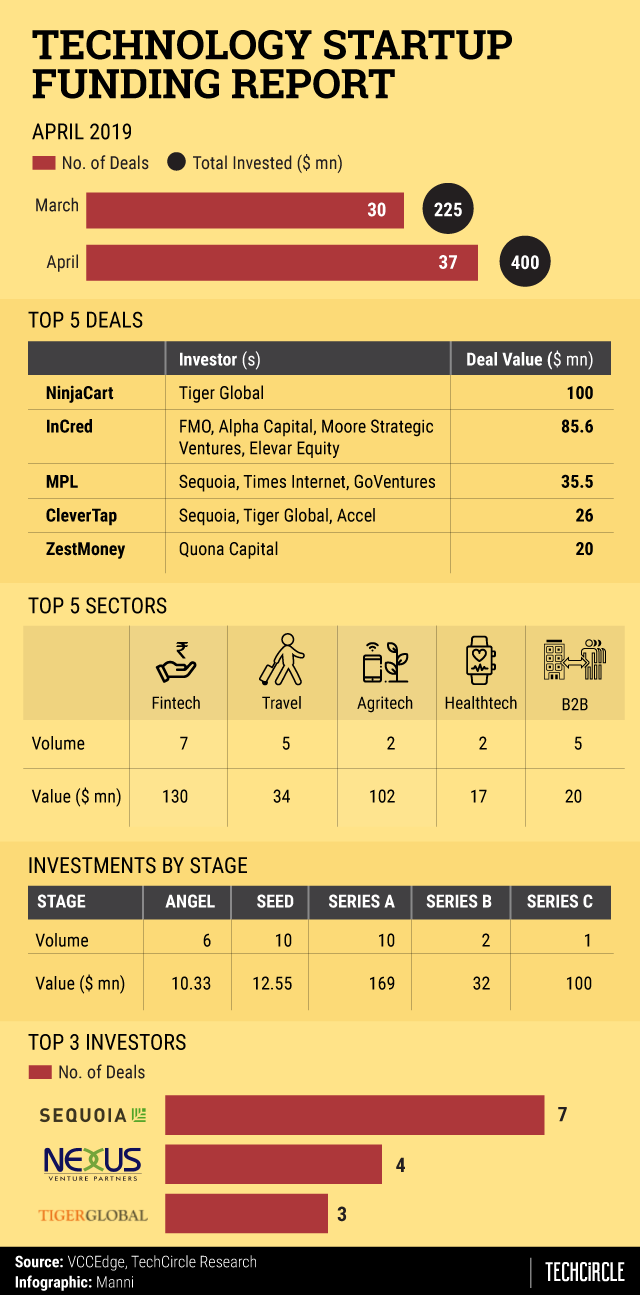

In all, 37 technology startups raised more than $400 million in the month of April, up from $225 million injected into 30 startups in March.

In April, Bengaluru-based business-to-business agri-marketing platform NinjaCart was among the startups that received the largest cheques. It raised $100 million from Tiger Global. The New York firm picked up 26.47% stake in lieu of this investment. Because of this funding, NinjaCart’s valuation rose to $321 million. The platform enables farmers to sell vegetables and fruit directly to shops, retailers and restaurants.

The arrival of a marquee investor like Tiger Global is a validation of the larger scope of agri-tech in India, which is yet to produce a proven, scalable model. While over half of India’s population is engaged in agriculture and allied industries, the yields are so disproportionate that the sector accounts for just 17% of the country’s gross domestic product. This is where startups and investors believe tech-enabled innovations can work wonders, and meaningful investments can change the historically negative notions on returns. A host of startups dealing with precision agriculture, Big Data, Internet of Things (IoT), sensors, and robotics are working on bringing efficiencies to this sector and it is showing results. Startups like NinjaCart, CropIn Technology, Aibono, Stellapps, and Skymet are innovating on the age-old systems and processes while an increasing number of angels and venture capital firms including India Quotient, AgFunder, Omnivore Capital Management Advisors, Kalaari Capital, Blume Ventures and Nexus Venture Partners are opening up their chequebooks.

Online loan platform InCred Financial Services Ltd was another startup that secured a large cheque of $86 million in its Series A funding round led by Dutch development bank FMO. The company plans to use the fresh capital to boost its balance-sheet lending as well as to strengthen its technology initiatives to drive analytics and risk-management capabilities.

Moreover, the financial-technology segment was the flavour of the month, with seven startups receiving more than $130 million alone. The agriculture-technology segment also picked up pace, with two startups accumulating $102 million funding in April.

Deal-making progressed with a lot of activity at the Series A stage. A total of $169 million was invested by early-stage investors in Series A-stage companies.

Among other investors, venture capital firm Sequoia Capital India alone emerged as the leading and most active investor in April, closing seven tech startup deals, despite losing some key executives last year. Abhay Pandey, managing director, moved out of the firm after the resignation of another high-profile managing director VT Bharadwaj, who decided to step down in April 2018. However, last month, Google's South East Asia and India vice-president Rajan Anandan left the technology giant and joined Sequoia Capital India as a managing director to focus on the firm’s recently-launched accelerator programme, Surge.