Angel tax on agenda as startups prepare to pepper new govt with policy requests

With India’s general election wrapped up, startups and lobbies representing them are set to reach out to government departments with wishlists pertaining to policy measures that have been hanging fire.

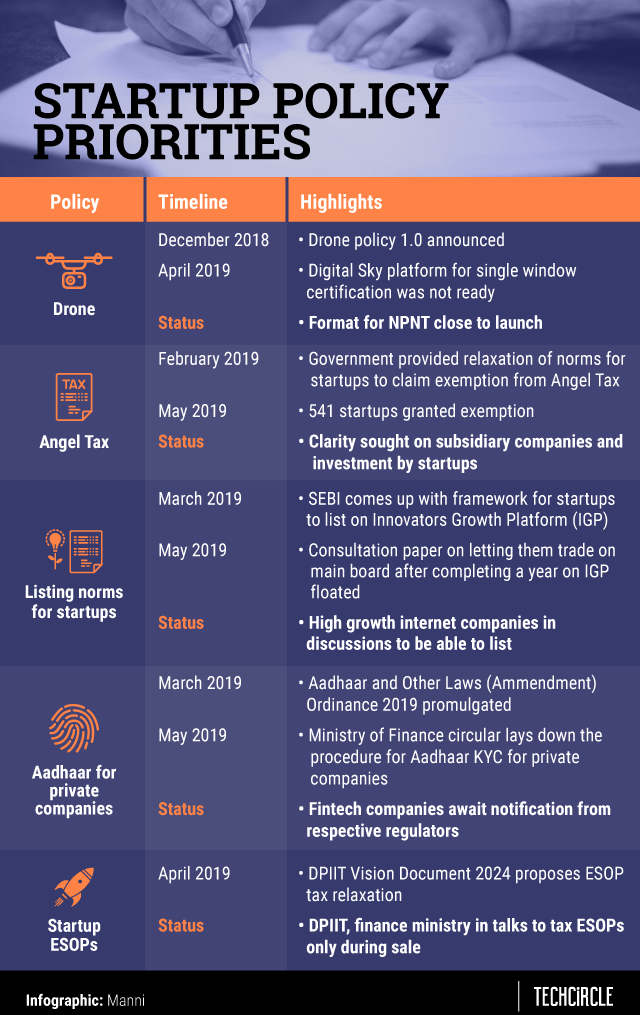

Startups see the first 100 days of the re-elected Narendra Modi government as critical for pressing ahead with policy steps initiated during the first term.

Their demands include resolving issues surrounding the contentious angel tax, clearing the air on changes in policy framework with regard to newer modes of transport, and friendlier state laws for the aggregator model in the mobility segment.

IndiaTech, an advocacy platform for internet companies and investors, will be reaching out to the Prime Minister’s Office, Department for Promotion of Industry and Internal Trade (DPIIT), policy think-tank NITI Aayog and other departments with a list of around 22 requests.

These include easing listing norms for high-growth internet companies, ease of doing business for wallet firms and creating a central KYC (Know Your Customer) platform for ease of verification in the absence of Aadhaar-based e-KYC.

Some of the other issues to be highlighted by the body include incentivisation of electric mobility solutions and a policy framework for carpooling as part of national mobility and transport reforms.

“IndiaTech has put together a comprehensive submission which is required for startups to be able to grow without facing policy and regulatory roadblocks,” Rameesh Kailasam, chief executive officer of IndiaTech, told TechCircle.

“The PMO has always been supportive of the startup ecosystem which we are sure will enable us to create a more enhanced ecosystem for innovation and employment in India,” he added.

IndiaTech’s founding members include messaging platform Hike, travel major MakeMyTrip, cab aggregator Ola and investors such as Steadview Capital.

LocalCircles, a community engagement and social network platform, had earlier written to the DPIIT with an appeal to tax Employee Stock Ownership Plans (ESOPs) only at the time of sale by the employee.

It had also sought tighter integration between the DPIIT and the Central Board of Direct Taxes (CBDT) to prevent further notices on angel tax for startups which continue to receive warnings under Section 56(2)(viib) of the Income Tax Act despite a relaxation in the norms.

“We are also discussing how to help startups for payment of reverse charge GST [Goods and Services Tax] which is applicable on services provided by companies located outside of India,” said Sachin Taparia, CEO at LocalCircles.

“As startups, many of them use cloud services, Google and Facebook’s advertising platforms among other services, which are invoiced outside of India and require startups to pay a reverse GST charge,” he added.

Meanwhile, Digital India Collective for Empowerment (DICE), an industry body which is working closely with the aviation regulator Directorate General of Civil Aviation (DGCA), said that a platform with the NPNT (No Permission No Take off) enablement was close to being ready.

“This is pursuant to the CAR (Civil Aviation Requirements) framework released in December last year and our working group on drones is invested in getting NPNT certification off the ground,” said Saranya Gopinath, co-founder of DICE.