Why Bigbasket will dip its toes, but not dive into the physical grocery market

At a time when firms are looking to blend stores with e-commerce in their omni-channel attempt to attract customers, online grocer Bigbasket remains clear about one thing: It does not aim to be a cross. At the most, it will sling unmanned vending machines at residential neighbourhoods for instant gratification by the offline public, in a nod to bricks and mortar -- but building giant swanky supermarkets on vacant lots remains out of the question for the online-focused grocer.

The market leader in the online grocery space would rather conquer all of retail through the e-commerce channel, capping bricks and mortar to wallet-operated vending machines only.

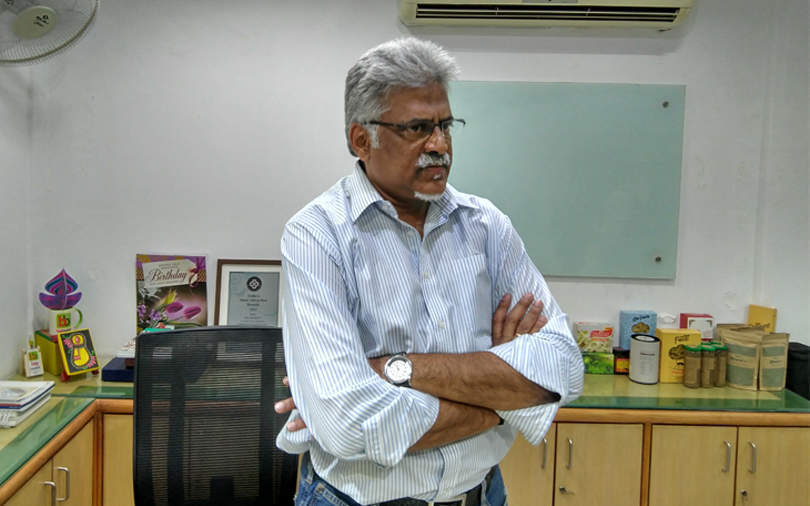

“We don’t have the need to go omni-channel just because other players in the space are doing this. It is now proven that there is a significantly large customer base that wants to shop for its grocery needs online,” Hari Menon, co-founder and chief executive of Bigbasket, told TechCircle.

Menon’s digital bias stands out from those of players wanting to offer an omni-channel experience as part of which customers can order online and pick up at the store, or can order online and have their purchases delivered home, or can visit the store.

Flipkart, for example, wants to test the bricks-and-mortar format, going by The Times of India. Only last month, the Walmart-owned homegrown firm’s online grocery brand Supermart launched its operations in Mumbai, marking its fifth port of call.

Reliance Jio, whose parent Reliance Industries Ltd runs India's largest offline retail ecosystem, is also gearing up for the launch of its omnichannel grocery offering even as Amazon aggressively expands its food retail business. Meanwhile, Gurugram-based Grofers has hotted up the online grocery space with its SoftBank-led $200 million fundraise last month.

But Bigbasket remains unfazed by the funding and omni-channel developments unfolding in the sector, having itself raised a $150 million round last month led by South Korean firm Mirae Asset.

That unruffled and calm composure can be attributed, in large part, to the market-leading success resulting from the firm’s efficient online model, which Menon says has shaped up over the years. He added that Bigbasket, with its online-focused model, will figure out a way to expand its customer base through marketing.

A wave of vending machines

In line with its capped bricks-and-mortar play, the firm is unleashing a wave of vending machines across neighbourhoods as part of “BB Instant”.

Although the machines support only wallet-based payments now, such as BB wallet and Paytm, Bigbasket says the next batch will enable credit and debit card transactions as well.

Under the strategy, every operational premises will have two machines storing 48 products between themselves, including fruit, vegetables, milk and snacks.

Already, 350 such vending machines have been set up across cities including Bengaluru, Noida and Hyderabad. The plan is to install 3,000 such in Bigbasket’s 10 Tier-I cities within the next two to three months.

“We will have to adopt a different approach for this where we will look to expand by one locality at a time as opposed to launching in the entire city. We are not looking at individual houses for now until we figure out the economics,” Menon said.

The business will become positive when each vending machine starts generating Rs 5,000 a day, translating into around Rs 2 lakh per month. But, why is Bigbasket optimistic about this venture?

“It provides multiple channels for our customers to access our products and offers instant gratification. Secondly, we also see this business vertical playing a crucial role in our brand awareness and marketing play,” added Menon.

Road map

Besides BB Instant, Menon is also pumped up about its two other new businesses: BB Daily and the launch of its beauty store on its platform.

BB Daily is a microdelivery service that will primarily offer milk, among 549 others products including bread, eggs, dairy and fresh vegetables.

“Since we already have the rest of the supply chain in place, internally we are calling it the business of fresh produce. Offerings under this category will have just one delivery slot, which is between 5:30 am and 7:30 am in the morning,” Menon said.

Like BB Instant, the microdelivery service targets residential societies and aims to club up adjoining neighbourhoods into hubs for streamlining operations.

“The focus will only be on high-rises and apartment complexes. The idea is to make one hub cater to 10 complexes since the cost of delivery is high,” he added.

Likewise, the company sees a very big opportunity, particularly in Tier-II cities, for its new beauty category. While BB Instant and BB Daily will be available as two separate apps, the beauty product will be seen as one of the product categories on its main grocery shopping app. Eventually, Bigbasket plans to integrate them all.

Menon says the at-launch-scale of BB Instant and BB Daily was made possible through three recent acquisitions; Kwik24 for BB Instant and Morning Cart and Raincan for BB Daily.

Supply chain 2.0

A significant portion of the $150 million that Bigbasket raised recently will go towards scaling up its supply chain efficiency, where investments will be primarily made in the backend and technology.

As part of the initiative, Bigbasket will construct large dark stores, which are essentially its distribution warehouses. In terms of size, the new dark stores will be big as 20,000 square feet, far bigger than its existing dark stores, which measure 4,000-5,000 square feet.

As part of the game plan, Bigbasket will set up 100 such large dark stores across its 10 Tier-I cities. Already 40-45 dark stores have been set up. The objective is to house a larger range of products and reduce the travel distance for last-mile deliveries, eventually translating into lower costs.

So how does this benefit Bigbasket’s customers?

“Eventually, two-hour deliveries or same-day deliveries will become the new norm and next-day deliveries will become a thing of the past. Instead of the existing four delivery slots, we will soon have 23 two-hour slots to execute this,” Menon said.

Snapshot of operations

Bigbasket, which is currently the market leader in the online grocery space, has 12 million registered customers across 30 cities. The objective is to expand its base to 25-30 million.

As far as revenues go, Menon says the company is on track to almost double its 2018-19 revenues of Rs 3,200 crore for the current financial year.

Its primary grocery and home-needs shopping app sees around 150,000 orders per day. This excludes BB Daily, which alone saw 75,000 orders per day in just three months of its launch, according to Menon.

“Despite having 30,000 products across different categories, we have been able to increase our order fill rate to 99.6% from 99.5%, which is the best even by global standards,” Menon said.

Currently, Bengaluru, Delhi-NCR (National Capital Region), Mumbai and Hyderabad account for its top five cities.

Likewise, Bigbasket sources 85% of the produce directly from its farmers’ network through 38 collection centres across the country situated at farming locations.

Currently, its farmer network is 8,000-strong and Bigbasket purchases 10,000 tonnes of fruit and vegetables in a month.

“If we can buy 80% of the total produce from our current farmer network, our business will go up by four to five times. While we currently procure only 30% of their total produce, our future strategy would be to acquire more from the same farmer and nurture them deeper,” Menon said.