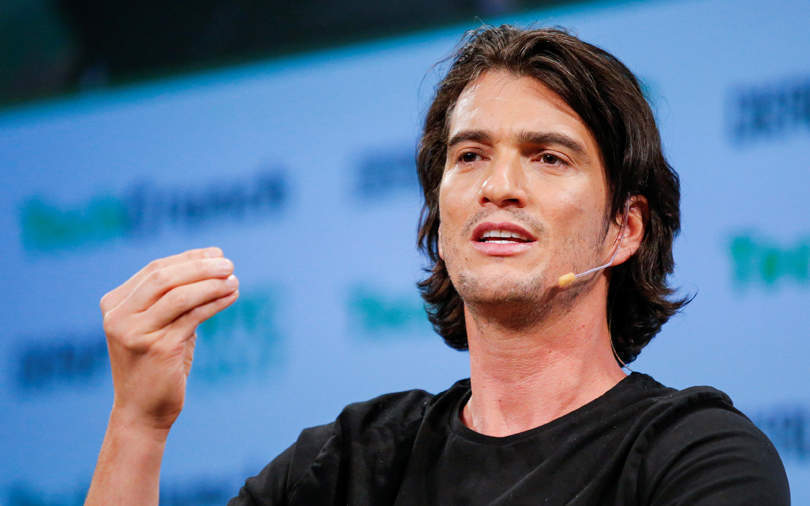

WeWork’s Neumann gives in to shareholder pressure, steps down as CEO

WeWork chief executive officer Adam Neumann will step down from his position in another twist to the loss-making company’s saga in wanting to go public.

“While our business has never been stronger, in recent weeks, the scrutiny directed toward me has become a significant distraction, and I have decided that it is in the best interest of the company to step down as chief executive,” Neumann was quoted in a statement from WeWork.

Taking over as co-CEOs are vice chairman Sebastian Gunningham, a former Amazon executive, and chief financial officer Artie Minson, a former Time Warner Cable executive. Neumann will be non-executive chairman of the board, the statement added.

The changes are effective immediately. The development comes after several concerns raised over the valuation that can be achieved in an initial public offering (IPO).

Earlier this week, the Wall Street Journal reported that a bloc of WeWork directors was planning to push Adam Neumann to step down as chief executive. Japanese conglomerate SoftBank Group’s Masayoshi Son was in favour of the same, CNBC added, with its report.

SoftBank’s tech-focused mega-corpus Vision Fund had backed WeWork at a $47 billion valuation in January this year. In a dramatic discount to that figure, Reuters had reported that WeWork could seek a valuation in its upcoming IPO of only between $10 billion- $12 billion.

In August, as an expression of interest towards an IPO, the office space-as-a-service provider filed its S-1 with the Securities Exchange Commission, disclosing its financials.

“We have a history of losses and, especially if we continue to grow at an accelerated rate, we may be unable to achieve profitability at a company level (as determined in accordance with GAAP) for the foreseeable future,” the filing read.

Neumann’s share rights were also criticised in light of the S-1. He will now reduce his voting rights from 10-to-1 to 3-to-1, which would mean he no longer has majority control, according to a WSJ report.