Sequoia leads $5.5 mn investment in Leap Finance

Sequoia Capital India, the Menlo Park, California-headquartered venture capital firm’s local investing arm, has led a $5.5 million investment into student loans financing platform Leap Finance.

The fundraise also saw participation from non-banking finance startup InCred’s founder and CEO Bhupinder Singh, rewards-based credit card payment platform Cred’s founder and CEO Kunal Shah, among other angel investors, a statement from the platform’s Singapore-registered parent entity Leap Technologies said.

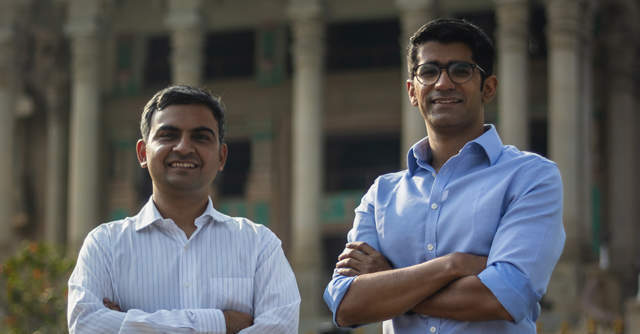

The fresh infusion, which is the first round of external capital in the company, will help it build its platform and hire teams across its Bengaluru and San Francisco offices, co-founder Arnav Kumar told TechCircle.

It is currently a 25-member team.

The fintech platform provides loans to Indian students pursuing international higher education.

“Indian students make up for 25% of a class in many top graduate programs in the US. These are smart, hard-working students who got in the best programs and have a great future ahead. Yet, the education loans they avail of are at interest rates twice as high as their American peers,” Vaibhav Singh, co-founder at Leap Finance said.

This disparity stems from systemic inefficiencies and lack of innovation, Singh added.

The startup claims to have innovated across functions of technology, financial structuring and risk, to bring down the interest rate and improve customer experience.

“Our underwriting engine takes into account hundreds of data points across an applicants' past, present and future indicators to reach a decision. Our data engine processes this real-time to give a fast and accurate offer to the students,” Kumar told TechCircle.

Founded last year, Leap has financed education for over 100 students, supports over 150 schools in the United States. It aims to finance 1,000 students in the US in the upcoming fall season of 2020, offering them loans with interest rates starting as low as 8%.

“Indian students studying abroad today spend $15B annually and we estimate an annual credit need for >$5 billion against this. This attractiveness of the market, strong founder-market fit and Leap’s mission-driven team is what led to our belief in an early partnership with them,” Ashish Agrawal, Principal, Sequoia Capital India said.

Apart from Leap Finance, Sequoia has made at least 15 other investments in the Indian startup community in 2020, according to data on VCCEdge.

IIT Kharagpur alumni founded Leap Finance in 2019. Singh has 12 years of experience working with organisations such as Deutsche Bank and domestic lending startups InCred and Capital Float.

Kumar started his career with Deutsche Bank. Leap Finance makes for his second startup venture, having previously co-founded GoZoomo, a used car marketplace. He’s also worked with venture capital firm SAIF Partners.