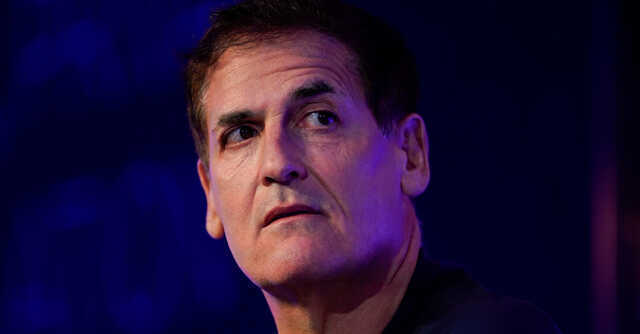

Billionaire Mark Cuban backs Indian crypto platform Polygon

Indian blockchain scalability platform Polygon (previously Matic Network) has joined the Mark Cuban Companies’ (MCC) portfolio.

The Bengaluru based startup has raised an undisclosed sum from the serial entrepreneur and investor who owns NBA’s Dallas Mavericks and is part of the investor panel on startup-focused reality TV show ‘Shark Tank’. Cuban’s net worth is estimated at over $4.4 billion (per Forbes), with more than 100 startups from varied sectors in the MCC portfolio.

While Polygon, which made the funding announcement on Twitter, has not detailed how it plans to deploy the fresh capital, Cuban did tell Coindesk that he plans to integrate Polygon crypto into Lazy.com, a MCC portfolio company that allows an easy way to display non-fungible tokens.

He said he had been using Polygon even before investing the company.

Founded in 2017 by Indian software engineers Jaynti Kanani, Sandeep Nailwal, and Anurag Arjun, the startup’s platform is a layer 2 project for Ethereum scaling and infrastructure development. It creates sidechains along Ethereum’s network to ensure users get faster transaction speeds and lower transaction fees without compromising security.

“Polygon effectively transforms Ethereum into a full-fledged multi-chain system (aka Internet of Blockchains),” the company says on LinkedIn. “This multi-chain system is akin to other ones such as Polkadot, Cosmos, Avalanche etc. with the advantages of Ethereum’s security, vibrant ecosystem and openness.”

Polygon’s scaling solutions have seen widespread adoption, with over 250 apps, 76 million transactions, and 790,000 unique users. Meanwhile, its native token (MATIC) has crossed a market capitalization of $13 billion and continues to be among the top 20 coins globally. Its price has grown by over 9500% over the last year.