Financialization is key to India’s growth: Zerodha, Zeta founders at AWS India Summit

The Covid-19 pandemic has turbocharged India’s digital economy drive that demonetization had put into motion back in 2016. With restrictions on public movement coupled with increased data penetration, online investments platforms have gained traction.

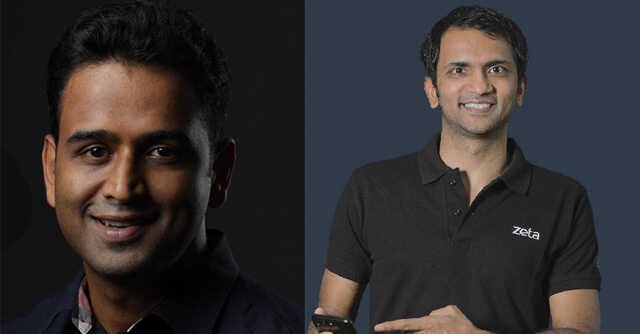

Nithin Kamath, the founder and CEO of online stock trading firm Zerodha, believes fiancialization is the key to India’s growth.

Kamath, along with banking technology stack Zeta’s founder Bhavin Turakhia, was a panelist in a session on day 2 of the ‘AWS Summit India’, an online event by Amazon Web Services focused on the cloud computing fraternity. The session was held on June 30.

“For the country to grow, financialization is the key. This means taking their money away from gold, real estate and investing into entrepreneurs. Knowing that we play a role in this is exciting,” Kamath said.

Read: The rise and rise of digital-first brokerage platforms

Zerodha began its operations in 2010. Until 2016, the process of opening an account was cumbersome. A simple account opening procedure would take three weeks and more than 40 pages of documentation. In the first few years of its operations, the company could only onboard 75,000-80,000 customers.

The entry of Aadhaar card coupled with India’s digital push have powered Zerodha’s growth.

“Then we had Aadhar which could be used for onboarding, now we are at 5 million customers. We went from 70,000 to 5 million users in 4 years,” Kamath said.

According to Kamath, Aadhar, Digilocker, e-KYC and other initiatives helped the company truly go digital.

Zeta’s founder Turakhia believes that there is plenty of room for growth in the Indian fintech sector. One example is how the country has less than five credit cards per 100 citizens, while in the US, every individual has access to two or more credit cards.

“Whether it's access to credit insurance, banking, savings, wealth creation, we're barely scratching the surface,” Turakhia said, adding that the digital infrastructure being created by the private sector and the government initiatives such as Aadhar sound promising for the long haul.

“We now have 750 million smartphones and India is sort of leapfrogging into mobile first banking and mobile first financial services,” said Turakhia.

“When more individuals have access to financial wellness, investments in credit, etc, it will substantially boost spending power of the economy as a whole, and enable a quantum leap,” added Turakhia.

Pain points in banking

Zeta, founded by Turakhia in 2015 aimed to address the pain point of banks running legacy software from the 90s. “Some banks still use code written on COBOL running on mainframes. We set out to build a complete ‘bank in a box’ like a platform from scratch, using modern technology paradigms,” said Turakhia.

Turakhia added that banks today have over 150 vendors in their technology roster. And this creates a lot of confusion in terms of blending them all together into one. “If banks truly wanted to provide an outstanding experience, then no amount of modification and legacy tech platforms will do,” he said.

Zeta currently provides solutions such as core banking platform, network connectivity, APIs, mobile applications and others for the entire gamut of banks.

“I strongly believe that in the next decade or so, not 30% of the banks will replace all of the technology and will go cloud native, or they will end up getting replaced themselves,” said Turakhia, strongly supporting the move to the cloud.

Read: Axis Bank to migrate 70% of on-premise infra to the cloud with AWS

Next frontier: financial education

The Bengaluru based fintech also launched its own Incubator to partner with startups and open their APIs to build on top of Zerodha’s offerings. The company is currently working with 18 startups today to work on niche case studies.

The next big step for Zerodha is to tap into the market of financial advisory, which Kamath believes presents a huge opportunity.

“We are working with a bunch of start-ups to enable an advisory ecosystem in this country,” said Kamath.

On the other hand, Turakhia believes that the edtech revolution will push consumers towards financial services in a big way. “Giving access to the same education, same financial services to everybody will pave the path to equal access and opportunity for everybody,” Turakhia added.