Russia-Ukraine crisis may aggravate semiconductor chip shortage: Moody’s Analytics

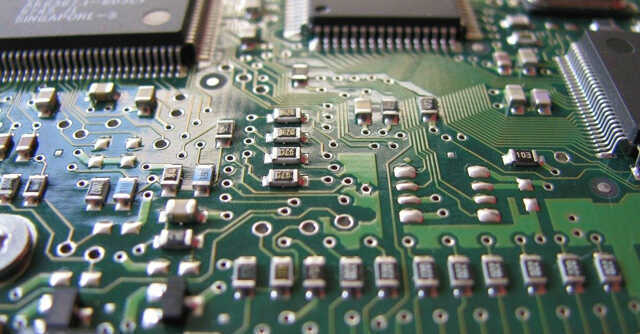

The ongoing Russia-Ukraine conflict is likely to aggravate the semiconductor chip shortage situation globally as the two countries locked in an armed battle happen to be major players of gases that are critical to the production of chips, according to a report by Moody's Analytics.

Moody's Analytics stated that apart from food and energy, the ongoing war may have massive ramifications in the already acute semiconductor chip shortage scenario. Russia supplies the global semiconductor industry with rare metals and Ukraine supplies specialty gases required by the chip-making industry.

Last month, Commerce and Industry Minister Piyush Goyal had stressed on the need for India to be self-sufficient in critical areas such as semi-conductor manufacturing as Covid-19 and rising geo-political tensions have exposed the fragility of global supply chains, adding that India has committed almost $10 billion to promote semiconductor manufacturing in the country.

“Neon and helium are both gases critical to the production of chips, and Russia and Ukraine are both major players in the global supply chain—so much that neon prices went up more than 10 times following the Russian annexation of Crimea in 2014," said the report.

According to the report, there is potential that the stress extends to the supply chain of semiconductors, which are key to manufacturing autos and other electronic equipment in the Asia-Pacific region.

The report further highlighted that palladium, another key component of the chipmaking process, may be affected given that Russia controls a quarter of the world’s palladium stock.

India is worried about the impact of the war between Russia and Ukraine on the countries trade with the two neighbours, as was articulated by finance minister Nirmala Sitharaman on Monday.

However, Moody’s Analytics, noted that it does not see an immediate impact on chip production because most major chipmakers have stockpiled raw materials due to significant demand growth during the pandemic.

“But if the Russia-Ukraine conflict drags on, chipmakers in Taiwan, South Korea, Japan, China and other countries will feel the impact. This will likely result in higher chip prices and longer lead times moving forward," the report added.

Analyzing the larger impact of the Ukraine-Russia conflict on the Asia-Pacific (APAC) region, the Moody’s Analytics reports said that iron ore, semifinished iron and iron bars are among the four largest commodities imported by APAC countries from Ukraine.

While direct trade between Ukraine and the APAC region, as per the report is limited, its disruption will be felt modestly in the region through its impact on inflation and supply-chain disruptions.

“Ukraine is not an exporter of energy to the region, so the conflict contributes only indirectly to higher energy prices either via blockages of shipments from Russia, and by the risk premium now priced into global crude oil and other energy products.

The Indian government is also assessing the evolving geopolitical situation and will decide on cutting excise duty on fuels if the current surge in crude price lingers longer than can be absorbed by state-run fuel retailers, as reported by Mint earlier.

Food-price inflation could stay higher for longer due to high energy prices or due to the disruption of shipments of wheat, corn or seed oils. There will be a modest impact from any disruptions of exports from the APAC region destined for Ukraine,” the report added.

The impact will by far be much smaller on the APAC region than what is expected in Europe, which is much more highly dependent upon the food and industrial goods coming from nearby Ukraine, the report concluded.