40% of global real-time payments originated in India in 2021: Report

India accounted for the highest volume of real-time payments among businesses around the world, with over 40% of all real-time payments made through 2021 rising in India. According to a report on the matter by payment solutions provider ACI Worldwide, data analytics firm GlobalData, and the Centre for Economics and Business Research (CEBR), India made 48.6 billion real-time payments through 2021 – which is over 2.6x higher than China at second place with 18.5 billion real-time transactions.

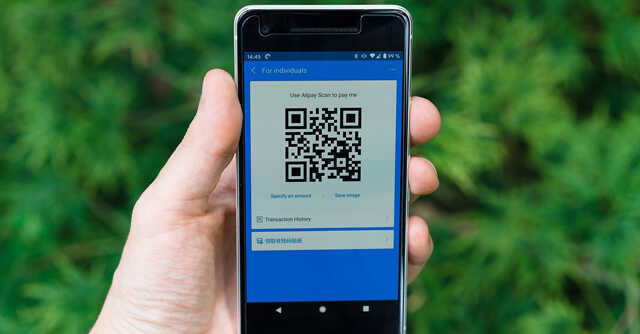

The report said that an increasing adoption of unified payments interface (UPI) and QR code-based merchant payments in India, coupled with a boost to cashless payments across businesses and consumers due to the covid-19 pandemic, has led to a boost in real-time payments in the country. As of 2021, 31.3% of all payments made in India were made through real-time payment instruments such as UPI.

Real-time payments across businesses and merchants refer to instantaneous digital payments that facilitate transfer of funds within a few seconds, as opposed to older payment systems such as credit notes or cash that required days to be credited across accounts.

Owen Good, head of advisory at CEBR said that a higher volume of real-time payments can “improve liquidity in the financial system.”

Explaining how this works, Good added, “Workers are paid quickly, allowing them to better plan their finances. Businesses have more flexibility and reduce the need for burdensome cash flow management.”

Sam Murrant, lead analyst at GlobalData, said that developing economies such as India, which had fewer existing electronic payment instruments and relied more on cash, are fuelling the growth of real-time payments.

“Mobile in its multiple forms will shape the trajectory of real-time payments for developing markets. India provides the template for mobile wallet integration with underlying real-time payment systems,” Murrant added.

Going forward, the report said that real-time payments in India are expected to grow at a compound annual growth rate (CAGR) of 33.5% through 2026. The growth pace ranks behind Brazil and Oman, although the volume of transactions in either of the two nations is significantly lesser than India’s.

Finally, the report also added that real-time payments added $16.4 billion to India’s economic output, or 0.56% of the nation’s gross domestic product (GDP), in 2021. By 2026, this contribution is tipped to rise to $45.9 billion – or 1.12% of the nation’s GDP.