Union Bank of India launches MetaVerse Lounge and Open Banking Sandbox environment

Union Bank of India has announced the launch of a Metaverse Virtual Lounge & Open Banking Sandbox environment. This initiative is in partnership with Tech Mahindra.

Uni-verse, the bank’s Metaverse Virtual Lounge, will host product information and videos in the initial phase. Uni-verse will deliver a unique banking experience to customers by providing them information on the bank’s deposits, loans, government welfare schemes, digital initiatives etc. in a way as if they are in the real world.

The bank has also launched an Open Banking Sandbox environment through which it will collaborate with fin-techs and start-up partners for developing and launching innovative banking products. From the perspective of fin-techs and start-ups, they will get the opportunity to have a platform to implement their innovative ideas.

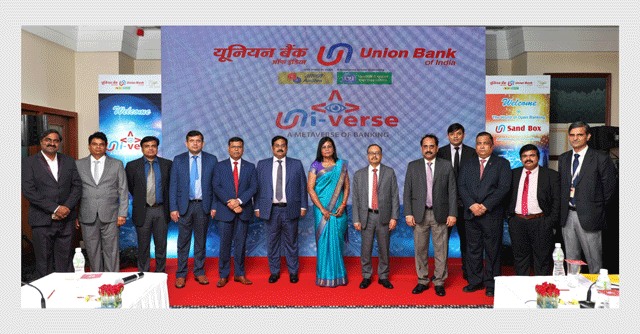

A Manimekhalai, MD&CEO, Union Bank of India, affirmed the bank’s adoption of latest technologies including Metaverse to transform customers’ banking experience to another level, at the launch event organised in Mumbai. Nitesh Ranjan, Executive Director, Union Bank of India, reiterated the bank’s commitment of facilitating an innovative banking experience to its customers through the launch of Metaverse and Sandbox.

A public sector bank, Union Bank of India as per its website has a network of 8850+ domestic branches, 11200+ ATMs, 8216 BC (business correspondent) points serving over 120 million customers. It has a mobile banking app, ‘nxt’ that provides a host of services such as balance enquiry, mini statement, paying loans EMIs, fund transfers, bill payments and the option to make investments such as fixed deposits, PPF etc.

The bank’s total business as of 31st March 2022 stood at ₹17,48,800 crore, comprising ₹10,32,392 crore of deposits and ₹7,16,408 crore of advances. The Bank also has three branches overseas at Hong Kong, Dubai International Financial Centre (UAE) & Sydney (Australia), one representative office in Abu Dhabi (UAE), one banking subsidiary at London (UK) and one banking joint venture in Malaysia.