Spend-IT: Equitas SFB invests in digital tech to boost CX

Chennai-based Equitas Small Finance Bank (SFB), is betting on digital technology to build banking applications as it is looking to enhance customer experience (CX) through personalised journeys.

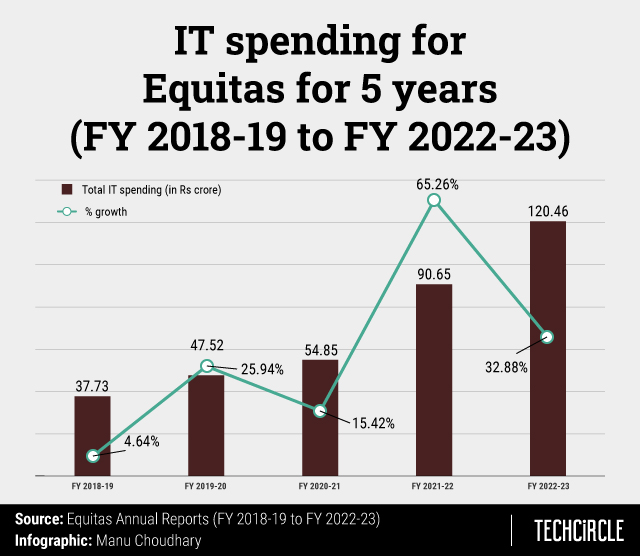

For the year ended March 31, the lender posted a 104% increase in the net profit, which stood at ₹573.59 crore over the previous year. Notably, the lender’s technology expenses for March 31 has also seen a whopping 32.88% increase and stood at ₹120.46 crore.

During FY23, Equitas SFB said that it has invested in a mobile app for customers with improved user experience/user interface (UI/UX) designs and other feature-rich options, which enables them to directly apply and avail of loans and other facilities offered exclusively to borrowers.

Further, it made loan origination across verticals paperless and analytical, thereby enabling faster decision-making and quicker disbursements, it said.

The lender also upgraded its core banking software to the latest version to enable scale-up of business and launch differentiated services in the future. Of the other tech-led initiatives, the company invested in areas such as private and public cloud initiatives, and a unified customer relationship management CRM (sales and service), model to boost CX for internet and mobile banking.

The company gives credit to its ‘digital-first’ approach which it said, began since 2019-20, when it re-launched its Selfe platform to provide customers with an even faster digital on-boarding option from the comfort of their homes. On this platform, a customer can open a savings account or fixed deposit account in under find minutes with just Aadhaar and permanent account number (PAN).

Also, having an already strong technology backbone enabled the lender to immediately move most of its staff to Work From Home, when the need arose towards the end of March 2020.

In 2021, Equitas SFB also opened an Application Program Interface (API) kit facilitating the Banking-as-a-Service (BaaS) enabling Bank to collaborate with Fintech talent and leverage Innovation led co-creation. This fintech accelerator programme helps fintechs to curate their products and define a go-to-market strategy. The ongoing programme, has now scaled-up, focusing on banking aspects such as payments, lending current account and savings account (CASA), transaction banking, API banking, governance and regulations.

The bank now has an in-house DEM (Data Exchange Model) for Cheque Truncation System (CTS) with enhanced security, replacing the existing Clearing House Interface (CHI). Last year, it also implemented a data mart for centralised MIS reporting and analytics.

In May, Equitas SFB signed an agreement with IBM Consulting to design and build a cloud-native platform architecture. Equitas’ President and Chief Information Officer, Narayanan Easwaran told TechCircle that the initiative will further simplify and transform the banking experience for customers.

"We are constantly elevating the CX with digitally enabled customer life cycle management featuring Video enabled KYC fulfilment and Virtual Relationship Manager interactions," he said.

A recent report by Emkay Global Financial Services stated that banks like RBL Bank, Equitas Small Finance Bank, AU Small Finance Bank, and Federal Bank that are adopting a ‘digital first’ approach and are embracing technologies to enhance banking experience have reported better-than-expected growth in the last one year.