Accenture’s supercharged post-pandemic growth in India skids

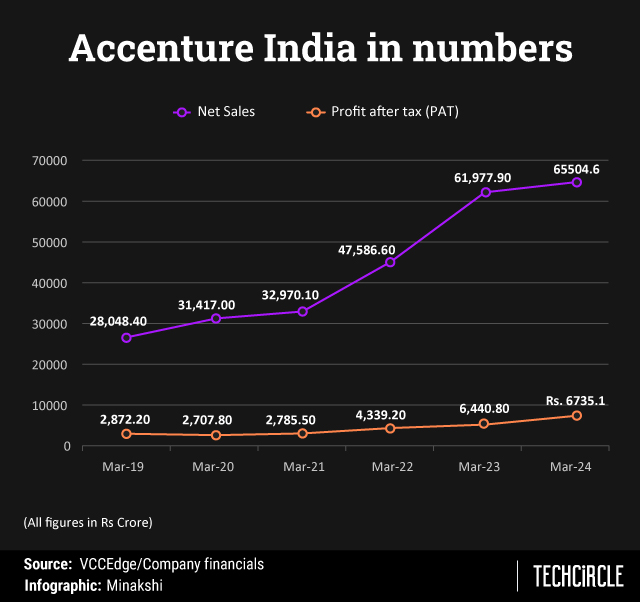

Global technology firm Accenture emerged as one of the largest multinational firms operating in India given its revenue, with its topline surging at a compounded annual growth rate of around 44% soon after the pandemic receded, has seen the growth decelerate sharply in FY24. Revenue of Accenture Solutions Pvt Ltd grew just around 6% to Rs 65,505 crore or around $7.8 billion for the year ended March 2024, as per VCCEdge, a data research platform and a sister unit of TechCircle.

Accenture Solutions which largely provides service delivery capabilities to Accenture Group Companies in addition to consultancy services for its domestic clients, saw growth come down to a crawl in both India-related and international business, with domestic revenue coming to over Rs 5,000 crore mark last year.

This comes after it experienced rapid growth, particularly between 2021 and 2023, with a revenue increase of nearly 44% in FY22 and 30% in FY23. This was attributed to a surge in client projects post-pandemic.

Accenture, which did not comment on this article, has nearly doubled its revenue size in India over the past four years, employing over 300,000 people in the country out of a global workforce of 774,000. Globally, Accenture added 41,484 employees in the 2024 fiscal year alone.

Globally, Accenture's revenue for the fiscal year ending August 31, 2024, grew by 1% in U.S. dollars and 2% in local currency, reaching $64.9 billion. This was compared to $64.11 billion in fiscal 2023 after reporting 4% growth the previous year. (Accenture's global financial year runs from September to August)

Given that the bulk of Accenture’s Indian arm’s revenues come via its global parent, a notable trend is that India's growth somewhat mirrors the global trend. For example, in fiscal year 2022, Accenture's revenue reached $61.594 billion, a 22% increase from 2021. Likewise, in India, revenue surged 44% to Rs 47,587 crore. Hence, this trend may indicate a potential slowdown in growth for the current fiscal year after its post-pandemic expansion.

The company has a presence across 15 cities including Bengaluru, Mumbai, Pune, Chennai, Coimbatore, Delhi, Gurugram, Noida, Hyderabad, Indore, Kolkata, Jaipur, Bhubaneswar, Nagpur and Ahmedabad.. Accenture has been hiring and developing local talent as part of its growth strategy and has initiated various digital transformation projects. Its expertise spans cybersecurity to app development, with a $3 billion global investment to enhance its data and AI practices, including plans to double its global data and AI workforce over a period of three years.

Globally, Accenture’s Gen AI revenue was $900 million in fiscal 2024, compared to about $100 million in fiscal 2023. “This was an area where our clients continued to buy small deals and we focused on accelerating our growth here." CEO Julie Sweet said at the Q4 2024 earnings.

The rapid advancement of digital transformation projects globally, including in India, is also a key growth driver for Accenture, gaining market share from major local competitors like Infosys, TCS, and Wipro. The firm has also updated its annual revenue growth forecast to 3-6% for 2025, reflecting improvements in the macroeconomic environment and recent US Fed interest rate cuts.

Accenture's strategic partnerships with top technology firms like Adobe, Amazon, Salesforce, IBM, Google, Microsoft, ServiceNow, Oracle, SAP, and Workday further enhance its position in the digital transformation sector.

Accenture's performance is widely regarded as one of the benchmarks for the Indian IT industry, providing a glimpse into the expected outcomes for Indian IT companies. Given that a substantial portion of Accenture's workforce is based in India, its results may indicate the broader trends and potential outcomes within the Indian IT sector, along with the performance of other top-tier Indian tech firms.