Cashfree Payments’ CTO on building resilient, AI-native infra to drive product innovation

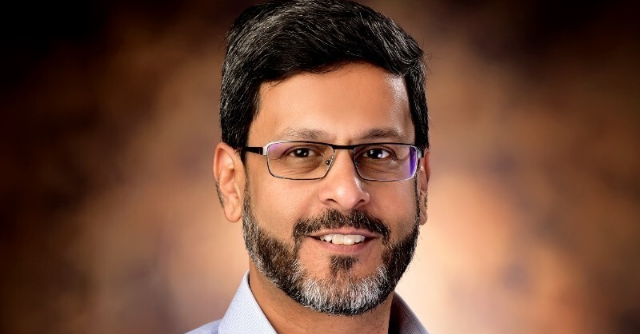

Cashfree Payments, an online payment aggregator in India, that holds over 50% of the market share in bulk disbursal through its 'Payouts' service, is betting on digital technology for growth and innovation. As one of the first payment providers to obtain a Payment Aggregator licence from the Reserve Bank of India (RBI), the firm is backed by the State Bank of India (SBI) and also collaborates with major banks to improve payment and banking infrastructure. Its solutions integrate with platforms like Shopify, Wix, PayPal, Amazon Pay, Paytm, and Google Pay, and are available in eight countries, including the USA, Canada, and the UAE. In an exclusive interaction with TechCircle, Ramkumar Venkatesan, the chief technology officer (CTO) of the fintech firm, shares insights into the company’s digital transformation journey, technologies driving India's digital payments revolution and the firm’s tech roadmap ahead. Edited excerpts:

Which technologies are you most excited about and currently focusing on?

At Cashfree Payments, engineering excellence drives our industry-defining innovations, enabling merchants to achieve more with less. Artificial Intelligence (AI) is central to this mission, fostering innovation both internally and for our users. We've embedded AI across our core product stack, from fraud detection to developer tooling, optimising operations, enhancing user experiences, and maximising merchant value. Integrating advanced AI models improves payment success, fraud prevention, identity verification, merchant onboarding, customer support, and internal productivity. We're actively leveraging Generative AI and LLMs to further these goals. AI will continue to alter the digital payments landscape, creating an intelligent and inclusive infrastructure that makes financial technology more accessible, adaptive, and future-ready for businesses of all sizes.

What is your tech team's size and skillset composition? Do you plan to expand through hiring or upskilling in the next year?

Our tech team is over 200 strong, a lean, high-performing group given the scale of infrastructure we're building for India as a product-first company. The team brings together deep expertise across backend systems, DevOps, AI/ML (Machine Learning), cybersecurity, and infrastructure, among other critical domains. We're committed to building a world-class, multi-skilled technology team that prioritises quality over quantity. Every engineer, even at the L1 level, is empowered with full ownership of their problem statement. This not only drives innovation in solving real merchant pain points but also creates organic opportunities for continuous upskilling. Our long-term vision is to build strong AI-native capabilities in-house while fostering a product-minded engineering culture. As we scale, we continue to grow across engineering, AI/ML, and product verticals—hiring strategically as the need arises and investing deeply in upskilling our existing talent.

What kind of innovation are you bringing with technology as an enabler? Can you provide examples of its impact on revenue or customer experience?

Cashfree Payments focuses on merchant needs, developing innovative solutions to address their pain points. We anticipate needs, enabling growth through our tech-first solutions like Cashien AI and Cashfree MCP Server. Cashien AI streamlines payment gateway integration, potentially reducing integration time by up to 40%. Cashfree’s Model Context Protocol (MCP) server acts as a universal connector, automating actions based on natural language queries. For example, it transforms WhatsApp-based order management for merchants without websites. Instead of a 15-minute manual process involving menu sharing, address collection, payment link generation, and confirmation, the MCP server automates the entire process. It monitors conversations, understands context, fetches menu items, generates and sends payment links, and confirms orders in real time, all without manual intervention, reducing the process to mere seconds.

How does Cashien AI streamline Cashfree Payments integration, and what differentiates it in the market?

In today’s era of internet-first businesses, every delay in integrating payments means a delay in going to market, serving customers, and unlocking revenue. Cognisant of this pain point, we’ve built Cashien AI, India’s first AI-powered developer assistant, to simplify and accelerate payment gateway integration. It is an intelligent, context-aware and stack-agnostic assistant that lives inside the developer’s code editor. Cashien AI, India's first AI developer assistant, accelerates payment gateway integration for online businesses, enabling faster launches and revenue. This intelligent assistant integrates into the code editor, generating production-ready code instantly. Supporting over 20 languages/frameworks, Cashien AI provides deployable code, detecting the tech stack and tailoring suggestions. Developers can chat within GitHub Copilot for immediate help, streamlining payment integration into an intuitive experience. Cashien AI empowers startups with real-time, stack-specific support, providing tested code and accelerating time-to-market. Embedded in VS Code, it boosts productivity by providing instant responses, suggesting snippets, and debugging issues, offering 24/7 Cashfree expertise and streamlining development.

What is your tech roadmap for the next two years?

Cashfree Payments is building a resilient, AI-native infrastructure to drive the next wave of product innovation. Building on our strong tech foundation, we're embedding AI and automation across the product and development lifecycle over the next two years. We're redefining "full stack" to include AI, user experience (UX), and product thinking, integrating AI into every team's workflow for building, shipping, and supporting products. AI is already accelerating development by generating test cases, auto-debugging failures, and streamlining framework upgrades, improving both speed and quality. In risk and compliance, machine learning models are detecting fraudulent activity and reducing chargebacks, fostering a safer ecosystem. Our roadmap is focused on three outcomes: improving development velocity, enhancing platform stability, and increasing merchant trust—while keeping operational complexity low. Ultimately, our AI is not an add-on for us ; it's integral to Cashfree's development DNA.