Spend-IT: Yes Bank’s tech spending grows nearly twice as fast as revenue

Mumbai-headquartered private sector bank, Yes Bank, has significantly increased its IT expenditures as part of its digital transformation strategy aimed at expanding its customer base and market presence.

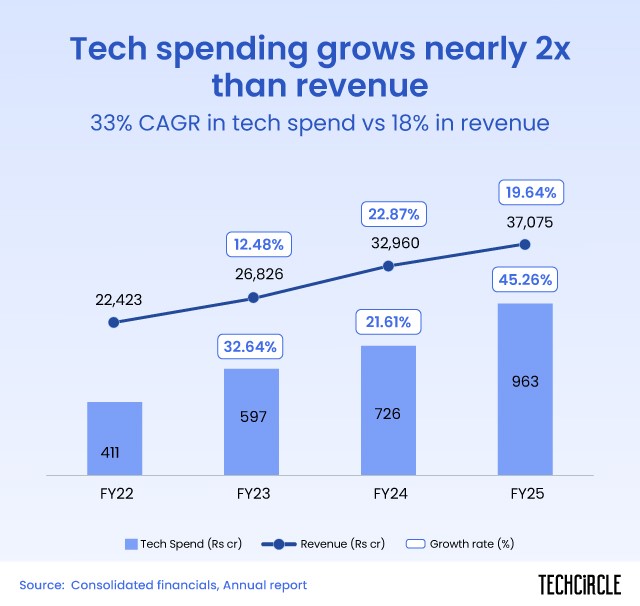

According to data compiled by TechCircle from the bank's financial reports, between fiscal years 2022 (FY22) and 2025 (FY25), the bank’s tech expenditure surged at a compound annual growth rate (CAGR) of 33%, compared with an 18% CAGR in revenue over the same period. The bank’s technology spend rose from ₹411 crore in FY22 to ₹963 crore in FY25, marking a growth of 134% in absolute terms.

In contrast, revenue expanded from ₹22,423 crore in FY22 to ₹37,075 crore in FY25, a 65% increase – a clear indication of the bank’s prioritisation of technology investments to support its long-term operational efficiency and customer experience goals.

The lender has been investing heavily in AI-driven solutions, automation, and cloud infrastructure to enhance cybersecurity, customer experience, and operational resilience.

The Bank has rolled out a series of technology-driven initiatives over the past 2-3 years to boost growth and enhance operational efficiency, Yes Bank’s Chief Information Officer, Mahesh Ramamoorthy, said in an interaction with TechCircle.

Yes Bank has implemented a comprehensive customer onboarding program, modernised its core systems, and adopted an Application Programming Interface (API)-led approach for seamless integration. It has also enhanced online and mobile offerings for small and medium enterprises (SMEs) and corporate clients.

“We collaborated with select technology firms — including both established players and emerging fintechs — to foster innovation in artificial intelligence (AI) and machine learning (ML),” Ramamoorthy said. “AI is integrated into customer interactions, transaction reconciliation, and data management processes.”

The bank is also exploring AI applications in risk management to strengthen its security and operational frameworks. An agile delivery ecosystem using DevOps and automated processes has been set up, along with an Innovation and Development Centre of Excellence to advance emerging technologies such as Generative AI (GenAI). Yes Bank is also expanding its GenAI capabilities through partnerships with companies like Microsoft, enhancing virtual assistants such as ‘Yes Robot’ to improve client interactions and automate banking services. Their AI-powered assistant, launched in 2019 using Microsoft Cognitive Services, remains key to customer engagement and product cross-selling.

The Bank also leverages Agentic AI with partners like Razorpay to transform onboarding and financial intelligence, and collaborates with Nucleus Software for wider digital and AI-driven transformation.

The bank’s cloud strategy focuses on scalable resources, resilience, and standardised security protocols. Ramamoorthy noted that the lender’s collaboration with various cloud service providers has helped achieve cost efficiencies, elasticity of resources, and automated recovery.

Yes Bank is also strengthening its IT governance through regular audits and updates, embedding security across policies and processes. “Our sustainability program focuses on compliance, security by design, and a zero-trust framework,” he added, emphasising ongoing education for both employees and customers.

An IDC report forecasts that AI spending in India will grow 2.2 times faster than overall digital technology spending over the next three years, generating an economic impact exceeding $115 billion by the end of 2027. Gartner also projects that end-user spending on information security in India will total $3.3 billion in 2025, a 16.4% increase from 2024.

These trends highlight that the banking sector's shift towards digital transformation, with a focus on AI, cloud infrastructure, and cybersecurity, aims to enhance customer experiences and streamline operations.

(Data compiled by Nitesh Kumar)