Spend-IT: Cholamandalam slows tech investments, sharpens digital strategy

After three consecutive years of heavy technology-led expansion, Chennai-based Cholamandalam Investment and Finance Company has dialled back its digital outlay, signalling a shift from accelerated investments to extracting greater value from existing platforms.

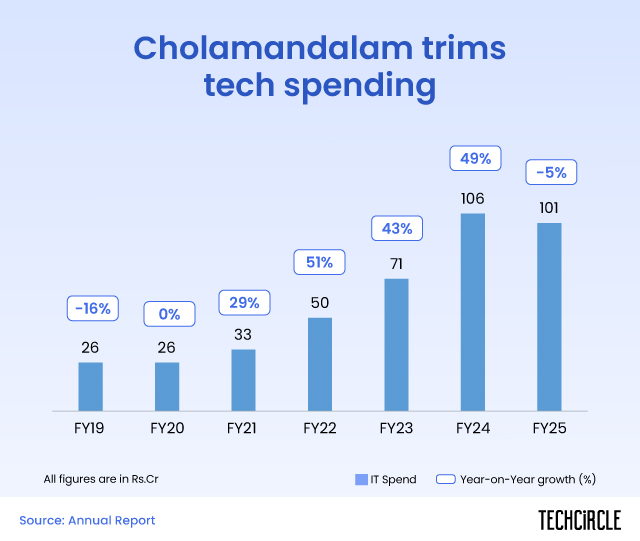

According to the company’s annual reports of the last 5 years, compiled by TechCircle, the Murugappa Group NBFC has cut its technology spending in FY25 to ₹101 crore, a 5% decline from the previous year. This marks the first contraction in digital investments in five years and comes after a period of aggressive scale-up.

Cholamandalam’s tech spends had risen 49% in FY24 to ₹106 crore, following a 43% jump in FY23 and a 51% surge in FY22. In FY21, investments grew 29% to ₹33 crore, while FY20 saw spending remain flat at ₹26 crore. The only other decline in recent memory came in FY19, when investments slipped 16% to ₹26 crore.

Executives attributed the earlier phase of accelerated spending to a deliberate push to build a digital-first backbone. Over the last three years, the company has digitised customer onboarding, deployed AI-driven risk scoring, automated loan origination via straight-through processing, and strengthened collections via mobile-led solutions.

“Having invested significantly in modernising our tech stack, the priority now is to leverage data and analytics for scale and efficiency,” the company noted in its FY25 annual report.

The recalibration mirrors a broader trend across the NBFC sector. Market leaders such as Bajaj Finance and Shriram Finance, which have already completed multi-year digital upgrades, are also shifting away from large-scale capex. Instead, they are focusing on embedding analytics in decision-making, cross-selling to existing customers, and expanding reach in Tier-II and Tier-III markets.

Industry analysts say the moderation signals a new phase in the sector’s digital journey. “The big bang phase of digitisation is tapering. NBFCs are now sweating assets, embedding AI/ML into underwriting, and monetising customer data,” said a senior BFSI analyst at a domestic brokerage.

For Cholamandalam, technology remains central to strategy despite the slowdown in spending. With assets under management (AUM) now exceeding ₹1.6 trillion, the company is sharpening its focus on first-time borrowers, MSMEs, and rural markets, where digital sourcing and risk management provide competitive advantages. Partnerships with fintechs, enhanced mobile-first collections, and analytics-driven credit decisions are expected to power the next leg of growth.

Increased automation has further improved efficiency by streamlining processes and cutting processing times. For example, Cholamandalam partnered with Infosys Finacle to upgrade its treasury operations earlier this year to boost loan processing and fund transfers.

That said, by moderating tech spends while doubling down on data-driven efficiencies, Cholamandalam is positioning itself for sustainable growth at a time when credit demand as well as competition among lenders is intensifying.

(Data compiled by Nitesh Kumar)