Excl: Exhilway close to investing in social networking app YoTurf

US and India-based private investment group Exhilway Global is close to investing in Mumbai-based Crackheads, the company behind the mobile social networking app YoTurf, sources privy to the development told Techcircle.in.

US and India-based private investment group Exhilway Global is close to investing in Mumbai-based Crackheads, the company behind the mobile social networking app YoTurf, sources privy to the development told Techcircle.in.

For more details on the funding click here.

When contacted, YoTurf co-founder Vaishnavi Iyer confirmed that the firm is raising capital but declined to share more details. "Yes, we are in talks with Exhilway, but the deal is not closed yet."

She, however, added the firm will use the funds for marketing as well as to set up an office in Mumbai. A part of the money will also be used for creating user database.

Rahul Kumar, country head, India, Exhilway, declined to comment on funding details, but added that the deal is in advanced stage of discussions.

The company was founded a couple of months ago by Abimanyu Jadhavrao (founder and CEO) and Vaishnavi (co-founder). An alumnus of NIIT Imperia Centre for Advanced Learning, Jadhavrao is an entertainment blogger. Prior to setting up YoTurf, he had worked at DDB Healthcare and Lifestyle as a project consultant. A journalist by profession, Vaishnavi had earlier worked at Times Group.

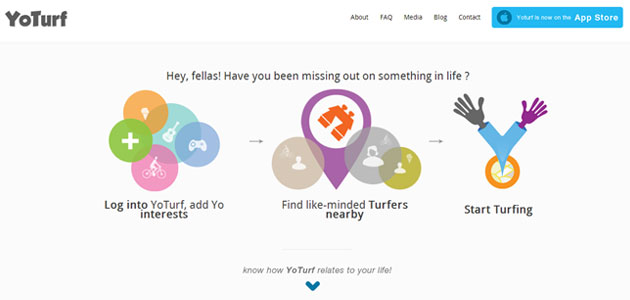

YoTurf is essentially a social networking app that aims to connect users in the vicinity based on their shared interests across genres. For instance, if a user is based out of Bangalore whose interest is reading, he/she will be connected with other similar people in the city. The app is available only on iOS platform as of now, and the firm is planning to launch it in Android next week.

However, YoTurf is not the only app which connects users based on their interests. Treetins, a social network launched by a group of entrepreneurs in Mumbai, lets users meet like-minded people outside their existing social circles over expressions and topics of interest (Read more on Treetins here).

Founded in 1974, Exhilway assists fund managers in the alternative asset class to raise funds for their private equity, infrastructure, hedge fund and private companies. In an interview with VCCircle early this year, Kumar had said that the fund is looking to invest as much as $5 billion in India and other emerging markets in the next five years. The firm is raising PE fund after selling off its hedge fund business.

Recently, Exhilway Global Opportunities Private Equity Fund invested Rs 25 crore in Livewell Healthcare, a Hyderabad-based company which is creating a chain of hospitals under the Laurel brand. Previously, it had also invested Rs 25 crore in IndiDebt.com, a yet-to-be launched debt funding platform.

(Edited by Joby Puthuparampil Johnson)