Online lending segment gains traction as over 25 startups emerge in two years

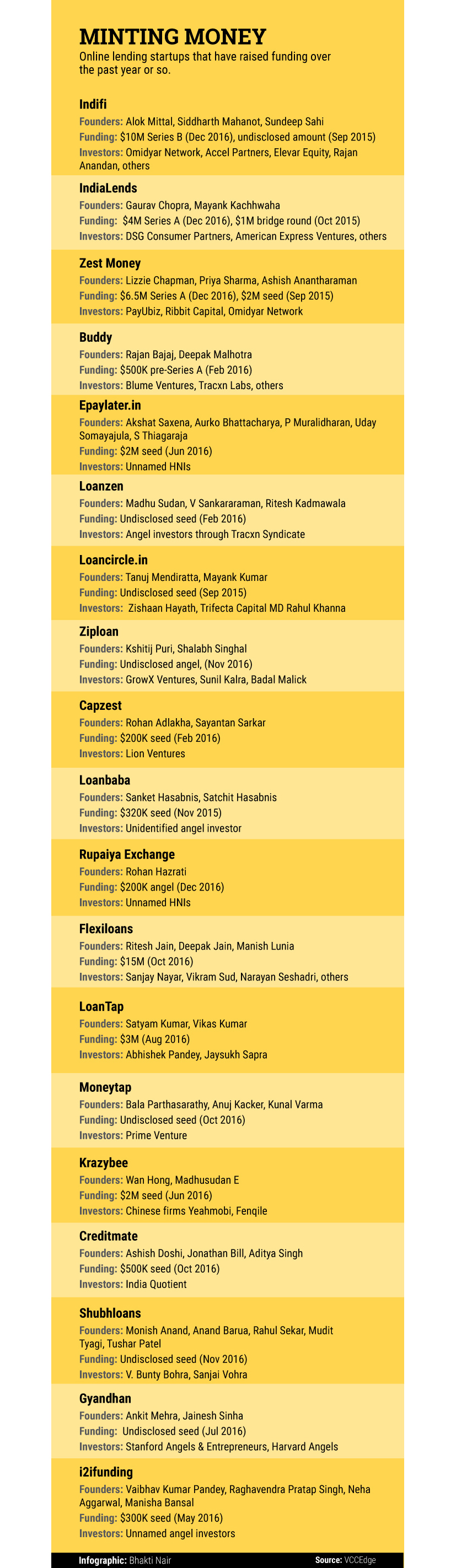

The last two years have seen the emergence of more than 25 startups in the online lending space, and the majority of them also getting funded, according to a TechCircle analysis. In fact, together with payments tech (primarily wallets), which hogged all the limelight recently thanks to the Centre's demonetisation move, lending startups ensured that fintech investments in India remained strong despite a funding slowdown in the first half of 2016.

Some of these startups are involved in microfinance while others are targeting advisory. In SME financing, startups like Indifi, IndiaLends and Zest Money have garnered a lot of attention from the investor community.

"The two broad segments where fintech is most active in India are payments and lending. Of the more than 600 fintech startups currently active in India, around 40% are payments and lending startups," according to Swissnex India's report "Fintech in India".

In fact, a recent Credit Suisse report said the online lending space offers a $600-billion opportunity globally, and that is expected to grow 5x in the next 10 years and reach $3 trillion. Within lending, peer-to-peer (P2P) and segment-based lending are fast gaining traction, it added.

Other startups that could be potential targets for investors later include names like Cash Suvidha, Goalwise, OptaCredit, Sqrrl Fintech, Cashe app, Fisdom and WealthApp.