Infosys steadies ship on back-to-basics strategy, focus on digital projects

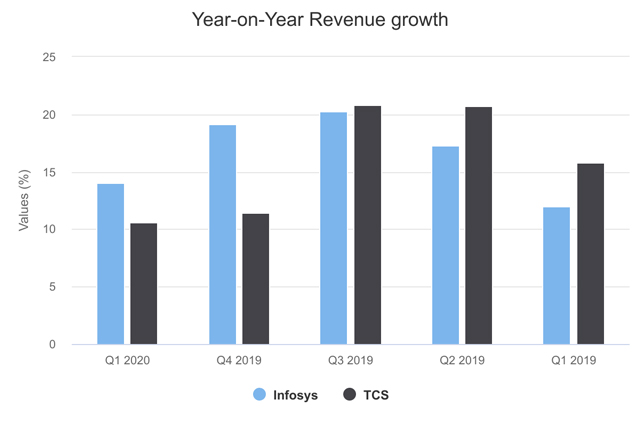

The shares of Bengaluru-based Infosys Ltd hit an all-time high of Rs 787 and maintained gains today after the company reported a 14% annual revenue growth for the first quarter ended June 30, 2019. The company had also revised its revenue guidance upwards for the current financial year 2019-20 by one percentage point.

Meanwhile, the shares of India’s largest software services company, Tata Consultancy Services (TCS), declined, post its lacklustre growth compared to expectations. TCS reported revenue growth of 0.4% sequentially and 10.6% year-on-year.

"Over the past year, Infosys has become aggressive in marketing and quality of services has improved when compared with TCS. Even with the share price rise, the price-to-earnings (PE) ratio of Infosys is lower," said a former senior Infosys executive, who did not wish to be identified.

Infosys PE was 23 while it was 25 for TCS, indicating that TCS still commands a premium over Infosys.

It has been a while since Infosys managed to deliver consistent growth over multiple quarters, and, to everyone's surprise, managed to go past TCS for a change. The company, under chief executive Salil Parekh, has not only managed to stay out of controversies but has slowly accelerated, with revenue growth being much higher than TCS' in the last two quarters.

Infosys, which was once considered as the IT bellwether, has since fallen behind even the US-registered Cognizant, which has a large base in Chennai. The company has a long way to go before it could challenge TCS or Cognizant. TCS has recently become the third-largest IT services firm behind IBM and Accenture, analysts said.

Under Parekh, Infosys has delivered better revenue growth than TCS sequentially in two of the last three quarters.

Parekh has managed to bring stability and focus, which will help the company maintain its pace, according to the executive quoted above. "When Vishal (Sikka) was there, the company strategy was all over the place by trying products, platform services, and microservices. Parekh is a services person and that has helped Infosys to focus on its strength," he added.

Behind the good results is the company's strong digital revenue growth, which stood at 42%, showing the company's success in clinching several large digital transformation deals.

“Salil has been able to stabilise the ship and set the direction. The leadership team in Infosys also seems to align better with Salil (Parekh)'s vision and leadership. This should result in Infosys delivering consistent growth in the near future,” said Pradeep Mukherji, president of IT advisory firm Avasant.

Sanjeev Hota, vice president and head of research at Sharekhan, said Infosys has managed broad-based growth, and the growth guidance showed promise as well the company's confidence.

Infosys has also been ramping up its US presence with headcount in the country crossing 10,000. While this has dented the operating margins, this will help the company overcome the visa challenges, analysts said.

Hota is only cautiously optimistic. "It is too early to say if they have started delivering consistent growth since they have been an inconsistent performer over the past 2.5 years. They have delivered on most accounts, which is impressive. The organic revenue growth was still lower than what the street was estimating while the $2.7 billion total contract value also included the acquisition," he added.

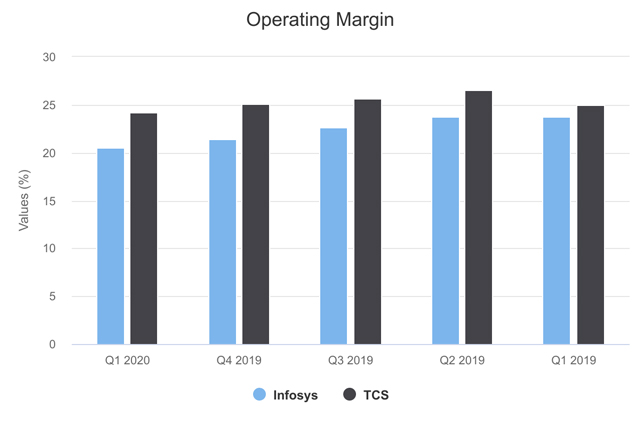

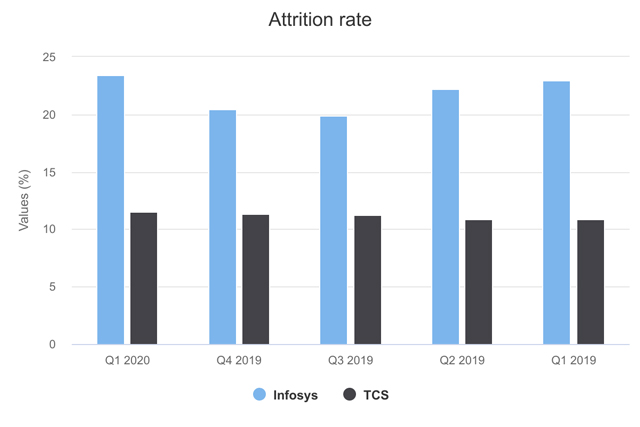

While the growth has been promising, Infosys faces multiple challenges like high attrition and lower operating margin (OPM) compared to TCS.

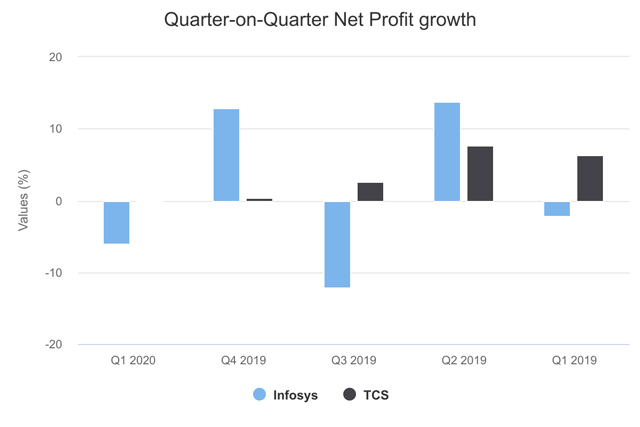

Operating margin is the gross profit a company makes for every rupee of sales and has a direct bearing on the overall net profit. Despite the revenue momentum that Infosys has seen, the company's net profit is not growing as fast as TCS because its OPM has been falling consistently.

During the current quarter, Infosys' annualised attrition rate rose to 21.5%, an increase of nearly 1% over the same period last year and by over 3% from the previous quarter. However, the figures for TCS is usually in the low teens, indicating scope for improvement for Infosys.

Hota attributed the attrition to several top and medium level exits while adding that the level was far from the comfort level for the company.

TCS's attrition rates are lower because of its demonstrated stability in the organisation and the team, Mukherji said.

“Though the salary levels may not be the best, there is a clear career path defined driven by strong HR practices and the Tata culture. In times of economic downturn, employees look for organizational DNA like those of TCS,” Mukherji added.

The human resources management in Infosys was a challenge, the senior executive quoted above said. "The company has become impersonal. It needs to communicate with its employees at the highest level more often," he added.

Another concern for Infosys has been its consistent decline in OPM over the last 12 months from almost 24% to 20.5% during the first quarter of this fiscal. TCS has only seen a 2% drop in OPM during the same period and stood at 24.2% at the end of Q1 Fy 20. It is, however, better than Cognizant where the OPM is usually in the mid-teens.

"Some of it is a reflection of the higher hiring in the US. Also, Infosys pays almost $1,000 more than TCS, which is a reflection of the employee composition in the US of both companies," the person quoted above said.

Infosys has delayed hikes for senior executives as the company has seen this drop in OPM. Despite the digital transformation deals, the company does not seem to be in a position to increase its margins, which still remains a concern for its chief executive and shareholders.