Outlook 2021: Consolidation, new collaborations for digital lenders, bolstered by organic digital transaction growth

After months of discussing moratorium, bounce rates and socio economic uncertainty, the announcement about successful vaccination has brought in the much-needed cheer. Financial services, though impacted directly by the economic downturn, are ready for a quick recovery, driven by growth drivers such as high organic adoption of digital payments.

The fintech market in India has grown to Rs 1,920.16 billion in 2019 and is expected to reach Rs 6,207.41 billion by 2025, expanding at a compound annual growth rate (CAGR) of 22.7% during the 2020-2025 period.

Despite the economic slowdown, MSME digital lending model alone, which accounts for a significant portion of digital lending and stands at $3 billion in 2020, is expected to triple in the next few years (Medici and RedSeer report).

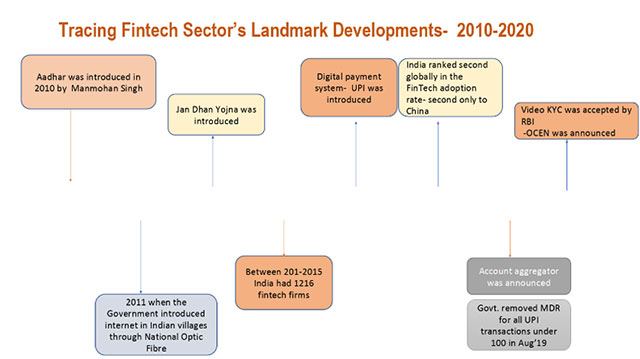

Before we explore the future growth and expected changes in the coming decade, it is imperative to look back at the key landmark developments of the past decade that have supported the growth so far.

Steps taken by the government for digitisation, regulatory changes to make digital financial services safer and smartphone penetration have acted as key enablers to the success of the fintech sector.

Digital finance and digital lending are supported by strong socio economic pillars and are certainly on a growth trajectory. Following are some of the key observations on what we think will drive the growth.

2021 will be a year of restructuring business plans, prioritising target sectors: Lending, more than any other sector is directly impacted by economic developments. Digital lenders, not surprisingly, therefore, saw a significant fall in the loan disbursal in the last few months.

The slowdown forced fintech lenders to remodel their processes and approach. For example, there is a renewed focus on technology driven underwriting and collection process to control defaults and losses. Increase in the organic digital payment adoption by end consumers will facilitate effective adoption of these new processes.

Higher momentum in partnerships between fintech firms and banks: In a recent interview, finance minister Nirmala Sitharaman pushed banks to use a co-origination model of financing to support lending. In a co-origination model, a bank and a fintech firm share the risk on their books in equal measure. The announcement reflects the acceptance of fintech firms by the large format traditional financial institutions. Fintech firms, more than ever, will be sought by the institutions for their inherent strengths of technology driven processes and distribution network.

We expect large banks and financial institutions to open their customer bases to fintech partners to benefit from their speed, agility, and customised solutions. Fintech firms, apart from the obvious business gains , will also benefit from the compliance and regulatory competencies that the banks have.

Strengthening of public infrastructure such as Account Aggregator will make digital lending faster and pervasive than ever before:

It was in 2011 that the Indian government introduced the internet in Indian villages through National Optic Fibre. From then till now, when mobile internet is ubiquitous, the Indian government and regulatory bodies have been vital enablers of the digital nation objective.

UPI, for example, has changed the way payments are made. Mobile payments largely led by UPI payments are likely to cross 45 billion transactions by 2022. RBI’s regulatory sandbox, initiated in 2019, was welcomed by startups as well as established financial institutions as a sign of change.

This year, the fintech sector will keenly watch the developments of Open Credit Enablement Network and Account Aggregator (AA). A consolidated information system for customers will drastically reduce the processing time. It is also expected to control default rates. At DLAI we will keenly observe the development and watch out for new business models with AA as a base. We believe this will further ease the availability of credit to MSMEs and under-banked individuals.

Moving away from single service company to platform approach: The Indian fintech industry is inching towards maturity. The expectations and demands of consumers for more value-added and customised services are also increasing.

Next few years, we expect fintech firms, especially the digital lending firms to move from a linear product approach to bundling of services and offerings. The bundling could be of financial services or of related/ relevant products and services. For example, health insurance firms are tying up with health monitoring apps. Implementation of OCEN will further make flow-based lending a reality. This will enable many ecosystem players to facilitate lending.

Cyber security measures and regulations: New technology led systems have also opened avenues for malpractices. Data privacy, hacking of accounts are important issues to watch out for. In the coming years, we expect companies to increase their spends and focus on fraud prevention and digital identity management and offer customers a safe online environment.

MSME’s will open doors for digital lenders: The estimated digital lending market size for MSME is $160 billion, of which only $3 billion is currently covered. On the supply side, the stringent risk policies of banks due to uncertainties of the pandemic have significantly reduced the credit supply to MSMEs. With the new wave of digital payment adoption, we expect a considerable increase in acceptance of digital lenders by MSMEs.

Intermingling of big tech, AI and platform approach to financial services is definitely changing the product first approach to banking and the trend is here to stay. Open Banking, Challenger Banks and many new models are yet to reach their true potential. The future clearly belongs to a customer driven, digital financial sector.

Alok Mittal, is co-founder and CEO of Indifi and executive committee member, Digital Lenders Association of India. The views in this article are his own.

Alok Mittal

Alok Mittal, is co-founder and CEO of Indifi and executive committee member, Digital Lenders Association of India. The views in this article are his own.