RBI must address three key questions before digital rupee launch

The government’s budget announcement that the Reserve Bank of India (RBI) will soon issue India's own digital rupee was presumably a reference to the pilot program for a digital rupee that RBI governor Shaktikanta Das announced late last year, considering that a full-scale rollout would be nearly impossible to pull off in just one year.

That said, there are three critical questions that must first be addressed. One, what problems is a CBDC in India trying to address? Second, what will its design look like? And third, what safeguards do we have in place to ensure the security of this currency and citizens’ privacy.

Globally, interest among central banks worldwide to experiment with or fully launch digitised currencies, has grown significantly. In developed countries, governments and central banks are concerned that big tech companies, such as Meta/Facebook, could issue their own digital currencies to the users of their vast networks, enabling them to accrue excessive market power. They are also concerned about the decline in the use of physical cash, which anchors public confidence in the monetary system. A central bank issued digital currency, they believe – although by no means unanimously – will not only address these concerns but will also bring in efficiencies in payment management.

The need assessment and motivations in India are different. For instance, while other countries, even developed economies, might see CBDCs as a means of promoting digital payments, that is not particularly relevant when we have an efficient, inclusive consumer payment system in the Unified Payments Interface.

Also read: Digital rupee will be the first and only digital currency in the country': DEA secretary Ajay Seth

India's UPI (Unified Payments Interface) landscape has grown tremendously in the last half-decade: from just 21 banks with a transaction value of 3.8 million rupees in July 2016 to nearly 300 banks with a transaction value of 8.3 trillion rupees as of January 2022, data from National Payments Corporation of India shows. Innovations like e-Rupi, a cashless and contactless prepaid voucher-based payment instrument built on the UPI platform also extend benefits to ‘non-banked’ beneficiaries. Even if CBDCs could increase inclusiveness a bit more, it would be on the margins and would need to be carefully weighed against the potential benefits.

RBI must set out the most significant long-term problem to which it believes a CBDC may be the answer. Its assessment should compare CBDC against the alternative means to achieve some of these objectives. This will have implications for design choices as well.

The proposed technology to develop this, as per the Finance Minister’s budget speech, is ‘blockchain’, a digitally distributed, decentralised, public ledger that exists across a network. But scalability remains a crucial challenge in the use of blockchain. Public blockchains demand a huge amount of computational power, a high bandwidth internet connection, and massive storage space.

For instance, Bitcoin and Ethereum are able to process 7 to 20 transactions-per-second (TPS), but they also face processing time. Given the size of the population in India, the technology must be suitable to sustain a massive number of daily transactions. The design must also ensure easy accessibility to people with poor digital literacy.

The third question is that of privacy and security. A direct model of CBDC, where customer accounts (or wallets) are all handled by the central bank, will not only give the government access to people’s personal spends but create a single point of attack which will make the system more vulnerable to cyber security attack protocols and safeguards regarding which organisations will be able to access sensitive CBDC payments data, and for what purpose will that data be used must be in place before India goes ahead with its digital currency plans .

Also read: Budget 2022: Digital rupee to be introduced as Central Bank Digital Currency in 2022-23

We need a robust data protection regime in place. Our legislation is still in draft stage and will take years to operationalise. It also allows sweeping exceptions for government purposes. Recently, former RBI governor D Subbarao, flagged that the lack of such frameworks could make the introduction of CBDC not just a technological challenge but also a "tricky political issue".

Answering these questions will not only provide a clear guideway for the launch of a digital rupee but will also ensure that the move truly benefits the Indian citizens and economy.

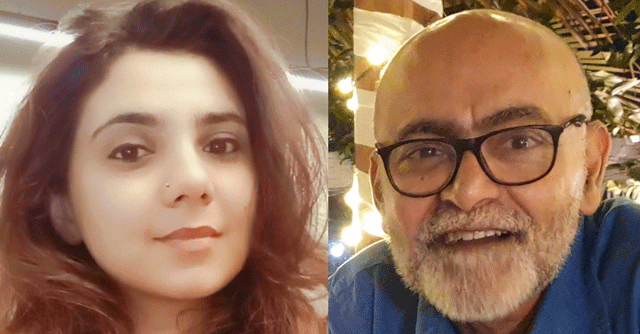

Nikita Kwatra, Hemant Adarkar and Vikram Sinha

The authors are Nikita Kwatra (Associate), Hemant Adarkar (Senior Fellow) and Vikram Sinha (Head, Project for Tech and Innovation) at Artha Global.