'AI will take away repetitive jobs, but create new ones'

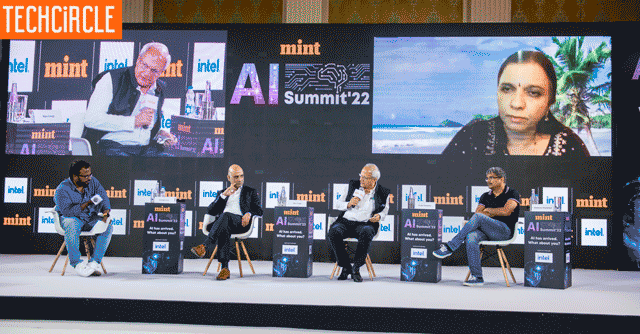

The deployment of artificial intelligence (AI) across sectors in India will take a large number of repetitive jobs out of circulation, replacing them with new jobs that require more human intelligence. Speaking at a panel discussion at the Mint AI Summit, chief executives and industry stalwarts agreed the industry will need to upskill labourers as automation and AI come to the fore.

The deployment of artificial intelligence (AI) across sectors in India will take a large number of repetitive jobs out of circulation, replacing them with new jobs that require more human intelligence. Speaking at a panel discussion at the Mint AI Summit, chief executives and industry stalwarts agreed the industry will need to upskill labourers as automation and AI come to the fore.

The panel comprised Ajai Chowdhry, founding member of HCL; Nitin Chugh, deputy managing director and head of digital banking at State Bank of India; Geeta Manjunath, founder and chief executive of Niramai Health Analytix; and Dilipkumar Khandelwal, managing director and chief executive officer of Deutsche Bank India. The panel was moderated by Sruthijith KK, editor-in-chief of Mint.

“It (the loss of jobs to automation) is going to happen, yes. But more jobs will come around. Someone has to work behind the AI as well. To become a superpower, we need to create the people to run the AI,” said Chowdhry. Khandelwal concurred, adding that the topics that humans run or do “will require a kind of upskilling”, and “humans will be progressed and taken forward”, which is the bigger challenge today.

According to Manjunath, AI can bridge the gap between healthcare in urban and rural infrastructures. “In the urban ecosystem, expert doctors are flocked by patients. Gaps in rural infrastructure were exposed through covid-19. AI as a helping tool can save doctors’ time through mundane analysis, leaving only the final decision to the human and improves productivity. In rural areas, AI can help make health workers smarter,” she said.

A similar impact is also expected in the financial sector, according Chugh. “Eventually, there will be a digital divide. Some people will have access based on digital literacy, but others will have phones but not know what to do. This is where voice solutions would help bridge the divide. Users will need AI on the edge, and banks today are creating voice solutions for those who are not literate,” Chugh said.