Spend-IT: How Bajaj Finance’s tech spending has outpaced total expense bill

India’s largest non-banking financial company (NBFC) Bajaj Finance that had ramped up its tech spending in the second year under the pandemic with IT expenditure nearly doubling in FY22 thanks to the introduction of an omni-channel framework for customers, continued on the digital transformation path last year.

The firm saw its total tech budget rising by close to a third with its key initiatives around big data, cloud migration and more.

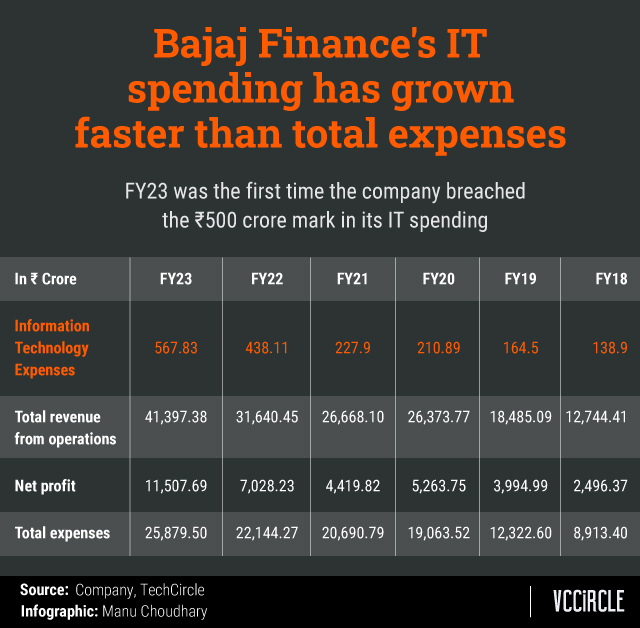

In the process, its tech bill breached the ₹500 crore-mark for the first time in the year ended March 2023 — in a year where the global banking, financial services and insurance (BFSI) industry started seeing slowdown towards the end of the fiscal year.

While the overall spends in its information technology infrastructure in FY23 was a small sum of total expenditure, data analysed by Techcircle shows that its IT spending has grown much faster than overall expenses.

While overall expenses have grown just under three-fold over the last five years, net outlay in the company’s tech budget has galloped four times. This is in sync with profit that has more than quadrupled in the same period.

In FY22, when Bajaj Finance had nearly doubled its tech spending over FY21, it had said: “(This) allows customers to move between online and offline in a frictionless manner … the company has seized the opportunity provided by the pandemic-induced transition to the digital world to expedite its business transformation process.”

Bajaj Finance has also transferred its entire data ecosystem and analytics workloads to the Microsoft Azure cloud platform.

“The company continues to explore and test the latest analytical tools and solutions and is currently working in areas like knowledge graphs,” according to its latest annual report.

Its official commentary on tech spending noted, “Technology is at the forefront of BFL’s business transformation journey, and it has continuously leveraged existing and emerging technologies to launch new products, accelerate customer acquisition and improve customer experience along with simplifying the back-office processes.”

Separately, Bajaj Finance also acquired a 41.5% stake in Mumbai-based SnapWork Technologies to "strengthen its technology roadmap". SnapWork offers consulting and implementation of software and related products for BFSI clients. The company has said that it would invest further in similar acquisitions going forward.

Notably, market research firm Gartner’s June report found that the IT spending by Indian banking and investing services is projected to reach a total of $11.28 billion in 2023, a 2% increase from 2022.

Debbie Buckland, director analyst at Gartner, said at that time that current economic headwinds have changed the context for technology investment in banking and investment services this year. “Rather than cutting IT budgets, organisations are spending more on the types of technologies that generate significantly higher business outcomes.”

Spend-IT is a running series where Techcircle scans through tech spending and budgets of companies in India