Spend-IT: Yes Bank’s IT budget buoyed 70% in FY24

Mumbai-headquartered private sector bank, Yes Bank, experienced a significant increase in its information technology expenditures for the fiscal year ended March 31, as the institution has initiated a digital transformation strategy aimed at broadening its customer base and market presence.

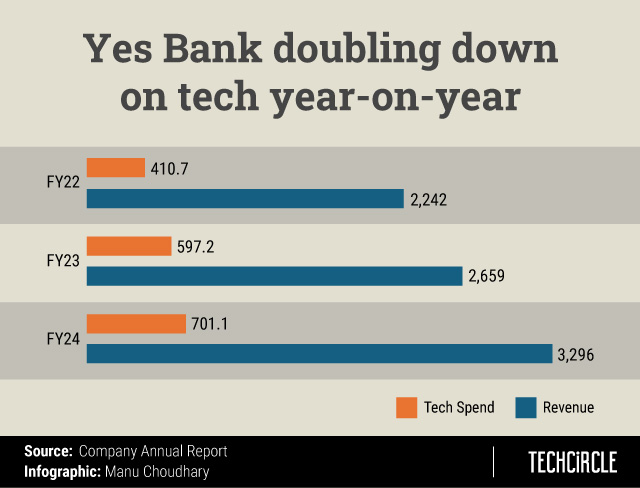

As detailed in Yes Bank’s annual report for FY24, the total IT expenditure over the past three years, from FY2022 to FY2024, has surged by 70.7%, exceeding ₹700 crore. The bank's IT expenditure grew by a substantial 17% in FY24 compared to the previous year. This rise is consistent with the bank's overall revenue growth, which escalated from ₹2,242 crore to ₹3,296 crore, reflecting a notable percentage increase of 47%.

In the last 2-3 years, the bank has implemented various initiatives to foster growth and enhance operational efficiency. These initiatives include a comprehensive customer onboarding program, artificial intelligence (AI)-driven data analytics, the modernisation of core systems, and an Application Programming Interface (API)-led approach for agile integration. Additionally, Yes Bank has improved its online and mobile services tailored for small and medium enterprises (SMEs) and corporate banking clients.

In a recent interaction with TechCircle, Mahesh Ramamoorthy, Chief Information Officer (CIO) of Yes Bank, indicated that the bank collaborates with select technology firms to foster innovation, particularly in the realms of artificial intelligence and machine learning. The bank partners with both established corporations and emerging fintech companies to generate synergistic value.

“AI is integrated into customer interactions, transaction reconciliation, and data management processes,” he noted.

Furthermore, the bank is investigating AI applications in risk management to bolster its operational and security frameworks, he said. Yes Bank has also established an agile delivery ecosystem (DevOps) featuring automated processes and has set up an Innovation and Development Center of Excellence (CoE) to advance new technologies such as Generative AI (GenAI). Currently, the bank is working on developing Proof of Concepts utilising GenAI to improve customer service.

‘Yes Robot’ – an AI-powered 24/7 personal banking assistant that uses Microsoft Cognitive Services, launched in 2019, continues to serve as a crucial channel for the bank, enhancing customer engagement through service offerings and facilitating product cross-selling and upselling opportunities.

The lender has transitioned from a reliance on robotic process automation (RPA) and workflow-based automation to a more innovative approach that involves reimagining processes, particularly through the application of machine learning models in targeted areas where significant enhancements in efficiency and experience can be achieved.

The cloud strategy at Yes Bank is centred on three key pillars: scalable resources that align with growth, the agility to recover from setbacks, and the promotion of security standardisation throughout the infrastructure. “We collaborate with various cloud service providers. Numerous efficiency improvements have been achieved, including sustainable cost reductions, enhanced elasticity of computing resources, on-demand scalability, and automated recovery and deployment of cloud-native development management tools,” Ramamoorthy said.

The bank is further strengthening its IT governance with systematic audits and updates, creating a collaborative cybersecurity framework. “We integrate security into all policies and processes, regularly assessing our IT risk posture to comply with regulations and best practices.”

Our sustainability program focuses on compliance, security by design, and a zero-trust framework, aligning upgrades with data protection standards. We also foster a strong security culture among customers and employees through ongoing education, he said.

In 2023, India's banking and investment services sector was projected to have invested approximately $11.3 billion in technology, as reported by research firm Gartner in May. IndusInd Bank dedicated between 8% and 10% of its overall budget to IT, while ICICI Bank's IT spending constituted 9.4% of its total expenditures in the previous financial year.

The Reserve Bank of India (RBI) is actively encouraging financial institutions to prioritise their IT investments to manage substantial transaction volumes, mitigate the risk of system outages or disruptions, and address fraudulent activities. This trend is expected to stay as banks strive to maintain a competitive edge within the evolving landscape of the Indian financial sector.