Why pre-emption is better than cure for staving off angel tax woes

As everyone else awaits presents from Santa Claus during this season of cheer, Indian entrepreneurs are bracing for something far more pernicious -- an angel tax notice.

Like a saas-bahu serial, this saga of the angel tax seems to keep developing new twists and turns with no end in sight. But before entrepreneurs who have received their second or third notice decided to call it quits and relocate to another country, we should pause for a moment and understand the context behind these notices and what entrepreneurs can do to shield themselves.

CASS is king

Last year, the income tax department moved to Computer Aided Scrutiny Selection (CASS) with cases being selected for limited or complete scrutiny on the basis of broad-based selection filters and in a non-discretionary manner.

The majority of the angel tax cases that have emerged have been generated by the CASS system owing to criteria set by it. After analysing various cases, it’s evident that there are certain key filters which determine whether a startup gets such a notice or not: historic losses, negative book value, large share premium, and low share base.

Though the first two are business issues all startups face as they pursue breakneck growth, the other two can easily be solved through careful capital structuring.

The price of premium

All valuation, regardless of method, is driven by the following formula:

Share Issue Price = Enterprise Valuation/No. of shares issued

The Share Issue Price here is derived by adding the face value and share premium.

The face or par value of the share is the nominal price of the share. The share premium is the amount in excess of the face value paid by any investor.

To understand how the share issue price deviates from its book value, let’s explore the journey of a fictitious startup -- Circle Apps Pvt. Ltd.

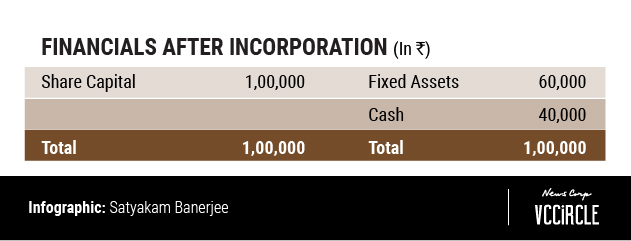

Like any typical startup, Circle Apps would begin its journey with an initial capital of Rs 1 lakh. The balance sheet of Circle Apps after incorporation would read as follows:

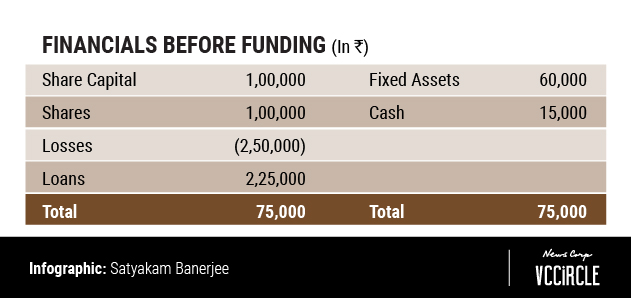

The founders bootstrap the business through personal loans or further equity until they can attract angel funding. They choose to fund the initial operations with a loan of Rs 2.25 lakh.

Their financials before any funding round would be as follows:

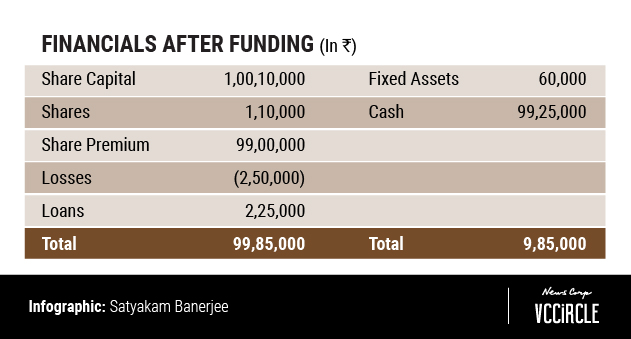

Circle Apps then manages to attract angel funding of Rs 1 crore at a post-money enterprise valuation of Rs 10 crore (arrived at via discounted cash flow) from various angel investors.

Share base: 10,000 shares

Face Value: Rs 10 each

Post-Money Enterprise Valuation: Rs 10 Crore

Share Issue Price: 10 crore/10,000 shares = Rs 10,000

Share Premium: Issue Price – Face Value = Rs 9,900

In contrast, the book value before funding would be determined as follows:

Assets – Liabilities divided by the number of shares issued

OR

75,000 – 2,25,000/10,000 = Rs 15/ share

After the Rs 1 crore round of funding, the financials would likely read as follows:

Therefore, Circle Apps, with a net asset value of negative Rs 15, raised capital at a share premium of Rs 9,900 -- a difference of 660 times.

Hence CASS, based on its filters, would automatically send out a limited scrutiny notice asking why a company with a negative net worth has raised capital at such a high premium. This explains why a large number of angel tax notices have been going out.

This further gets compounded over multiple rounds since the net worth would always be less than the enterprise valuation since the former is based on the value as of today and the latter is based on future earnings and growth.

Pre-emption is better than a cure

For most startups in India, this share premium is exceptionally high due to the mathematics involved in the valuation equation – a small share base or large valuation both result in this large premium.

Since a small valuation is obviously not desirable, the only other option is to increase the share base of the company. The only means of achieving this is to issue more shares, but issuing them at a premium would compound the angel tax issue and issuing them at par would result in anti-dilution protections coming in (anti-dilution is a measure that protects shareholders from any further issue of capital at a valuation lower than the one they invested at).

But another alternative exists in the form of the share premium that lies at the root of this issue.

Paring premium

The Indian Companies Act stipulates that the share premium can be used in the following ways (Section 52):

- Issuing bonus shares

- Writing off preliminary expenses

- Writing off commission paid or discount given on any issue of debentures

- Providing for premium on redemption of preference shares or debentures

Buyback of shares

By issuing bonus shares, the share base of the company immediately increases while the valuation of the company remains the same. What’s more, a bonus issue is not taxable since it is the capitalisation of existing reserves and not a gift or any income received by a shareholder.

Thus, if a 1:9 bonus issue is made (every shareholder holding one share gets nine bonus shares), the share base would increase from 11,000 shares to 99,000 shares.

Assuming the company raises its next round of funding an enterprise valuation of Rs 50 crore, the issue price would now be Rs 5050.55 (Rs 50 crore/99,000 shares) instead of Rs 45,454.55 (Rs 50 crore/11,000 shares).

This results in an 89% reduction in the share premium without changing the valuation of the company in any way or incurring any anti-dilution protection.

Higher face value

The second method consists of simply increasing the face or par value of the shares. Instead of issuing fresh shares with a face value of Rs 10, increase it to Rs 1,000 or above so that the overall premium comes down. Since share issue price = face value + share premium, having a higher face value would immediately lower its premium.

In the above example, if the face value of the shares is increased from Rs 10 to Rs 1,000, the share issue price’s share premium after the bonus issue would reduce from Rs 5,040.55 to Rs 4,050.55.

With these steps, the premium associated with the Rs 50 crore valuation round becomes lower than the premium associated with the seed round of Rs 10 crore valuation by 59%.

The angel tax is a unique artefact of the Indian tax code since it taxes a capital receipt as revenue. While this law has to change, it’s important that startups adopt these simple capital restructuring techniques so that they don’t get caught in the automatic filter behind these tax notices.

After all, Christmas is the season of angels, not angel tax.

The writer is the founding partner and chief financial officer of venture capital firm 3one4 Capital.