Machine Learning can make financial fraud prediction and detection simpler

Over the last decade, the world of finance has transformed from cash and documents driven to fast and convenient digital platforms. While the transformation helped billions of people, businesses, and governments, it created several challenges, such as the increased risk of financial fraud. As per a report by VynZ Research, the global fraud detection and prevention market will reach $85.3 billion by 2025. A significant chunk of this would be financial fraud.

Given the complexity and prevalence of financial fraud, it is impossible to detect most instances in a timely manner manually. However, machine learning provides several meaningful solutions to uncover financial fraud structurally. For the uninitiated, machine learning works as an additional layer on artificial intelligence algorithms and helps computer systems automatically improve their response by using the training data.

Like any other fraud, financial fraud such as money laundering, false insurance claims, money laundering, unscrupulous electronic payments, and bank transactions have iterating patterns. Financial institutions working in these spaces can deploy machine learning solutions to analyze the past patterns and predict fraud if similar incidents occur in any part of the ecosystem.

For example, banks and NBFCs can use the solution to predict the cases where a customer may turn into a willful defaulter. In instances of credit card theft and payment fraud, where scammers use stolen information to make payments, machine learning based solutions can identify suspected patterns, including purchase amounts, location, and purchase types based on customer’s history. These transactions can then be reported to the authorities in real-time. In another use case, machine learning could analyze the patterns of mass cyber-attack on payment networks in one part of the world to curtail similar incidents elsewhere. Such machine learning based solutions are already saving billions of dollars' worth of potential fraud every year and can be used for even more.

Apart from fraud prediction and mitigation, machine learning can also play an essential role in investigating any unfortunate instances of financial fraud. Since the investigators have to go through huge piles of data to discover a fine piece of evidence, machine learning solutions simplify their task by using algorithms deployed in similar situations in the past. As per a report by Capgemini, machine learning based fraud detection solutions can cut fraud investigation time by 50% while improving the accuracy by 90%. Furthermore, the cost and time saved could be utilized to enhance the systems further and make them more robust to deal with different possible fraud scenarios.

The use cases where machine learning predicts, detects, and prevents financial fraud are endless. Overall, the technology helps financial institutions deploy their technology platforms more confidently, extend the sense of trust to their customers, and keep the unscrupulous elements at bay. Therefore, financial institutions need to look for an experienced technology partner who can deploy well-designed data models and coherent business rules to make machine learning work. Moreover, the system should be periodically reviewed for performance so that the algorithm continues to become more effective and efficient. After all, trust is fundamental for any financial transaction.

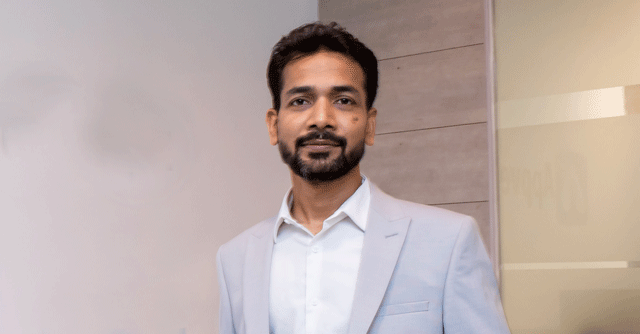

Ajay Kumar

Ajay Kumar is the Co-Founder of Appventurez