Spend-IT: Non-bank lender Cholamandalam ups IT budget

Cholamandalam Investment and Finance Company Limited (CIFCL), the financial services arm of diversified conglomerate Murugappa Group, has seen a huge leap in its technology spending for the year ended March 2023.

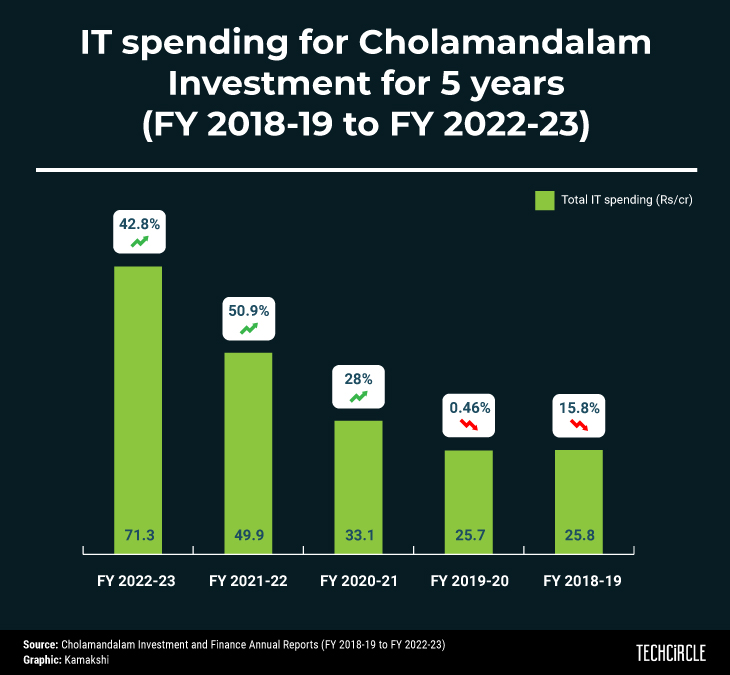

In FY2022-23, the Chennai-based company’s annual revenue growth of 28.09% outperformed its three years compound annual growth rate (CAGR) of 14.42%. Notably, the company’s technology expenses for March 31 has also seen a whopping 42.8% increase and stood at ₹71.31 crore, as against ₹49.93 crore a year ago period (March 31, 2022), as per the company’s exchange filing.

The four-decade old company which has over a 1,000 branches across the country, and more than 7,000 employees, said that while it has, over the last decade, encouraged digitalisation and introduced lean practices in its business processes, spanning loan originations, management and loan collections, since 2020, when the Covid-19 pandemic hit, it started embarking on a revamped business strategy with a digital push amid maintaining a strong liquidity position.

For example, CIFCL worked around a complete automation-first approach to streamline processes across businesses to offer a co-lending solution. This helped them process their co-lending applications much faster and ensured compliance with regulatory requirements, while significantly bringing down the cost of capital.

Last year, the company had also set up a financial operations (FinOps) practice to maximise cloud value with collaborative, data-driven decision-making from finance, technology and business teams.

In 2022, the company also adopted an e-waste management practice ensuring that e-waste is disposed of in the most scientific way, that the recycling organisation has a valid permit and follows the required protocols laid down by regulatory bodies.

The company has also adopted new software that has helped save at least 3,500 papers per month. This, according to the lender, has helped them in transitioning all paper-related processes to a digital platform and carry out minimal manual documentation.

CIFCL has further invested in training in cyber security and data handling awareness across organisation’s employees and also engage with domain experts for cyber security assessment.

The company also adopted strong artificial intelligence (AI) and analytics practices to transform business operations in the last few years. The company said, it receives more than 60,000-70,000 applications every month for the various services that it offers in terms of loans and equity. All these applications are subject to approval and decline, which is a cumbersome process. The analytics team through various business intelligence, data-driven predictive modelling simplified the process. The insights helped them find out what kind of incentive schemes are working for the company and customers.

Also, earlier, pricing used to be driven by market forces. By using advanced analytics and machine learning, the company has come up with a risk-based pricing engine to understand how to separate the risk of a market from individual applications. Earlier, every customer would get the same price but now the pricing varies according to the risk profile of the individual customer.

The lender has always aimed to create digital inclusion of tier III and IV towns, given that 86% of its branches are in these locations. Last year, the company built a scalable big-data repository to serve the data management, data access, and analytics needs of the enterprise across every segment.

“The aim is to build a repository of services that enables the company to provide a digital-ready and integration-easy option for all types of entities in our ecosystem to easily work with us,” it said.

Needless to say, the financial services industry is undergoing a significant transformation driven by digital disruption. The widespread adoption of digital banking and insurance applications has revolutionised how customers engage with their financial services provider. According to a report published in research firm Gartner in November 2022, the growth trend in the Banking, Financial Services and Insurance (BFSI) sector is expected to continue, with a CAGR of 5.7% over the coming years, leading to an estimated spending of approximately $715 billion by 2025.