Flashback 2018: From Bansals to unsung founders, meet the year’s movers and shakers

The Indian startup ecosystem’s top newsmakers this year were a combination of usual suspects and surprise packages. From high-profile departures and appointments to attracting millions (and billions) from investors, here’s a lowdown on who dominated the headlines in 2018:

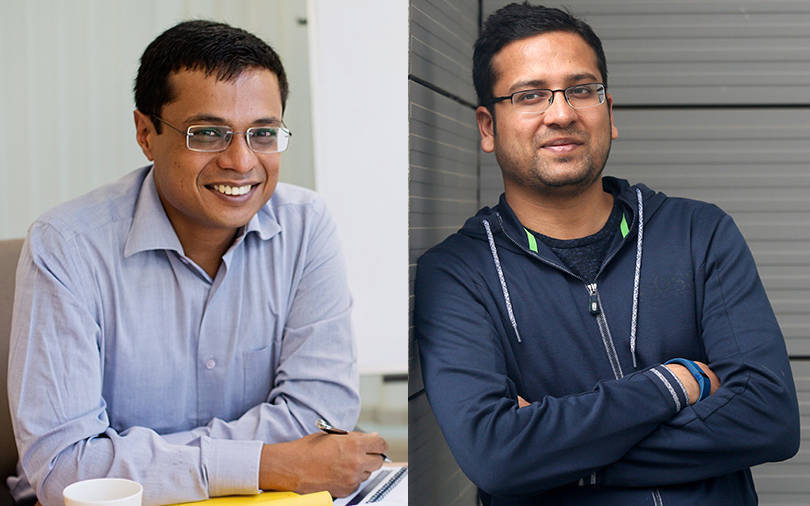

A tale of two Bansals

Flipkart founders Sachin Bansal and Binny Bansal had a tumultuous year. In May, the former Amazon India colleagues, who happen to share a common surname, sold the e-commerce company they had built from the ground up to Walmart, the iconic American retailer, for $16 billion.

The Bansals’ euphoria at pulling off the world’s biggest e-commerce M&A deal was somewhat dampened by Sachin Bansal’s abrupt departure from the company even before the ink had dried on the paperwork. Sachin Bansal, multiple media reports said, had fallen foul of Flipkart’s investors and even his co-founder. He did, however, leave about $1 billion richer from the sale of his 5.5% stake in the company.

Binny Bansal’s departure a few months later was even more unceremonious. In November, Flipkart’s group chief executive officer stepped down following an internal probe into allegations of personal misconduct.

Vijay Shekhar Sharma

When Warren Buffett’s Berkshire Hathaway picked up a stake in Paytm in August, it was a whole new high for the digital payments company’s founder Vijay Shekhar Sharma. After all, Sharma had managed to prise capital out of an iconic investor known to avoid internet investments like the plague.

Following Berkshire Hathaway’s investment, Paytm’s valuation soared to more than $10 billion. Sharma’s rising fortunes unfortunately attracted the wrong kind of attention. A couple of months later, he found himself embroiled in an extortion racket that involved two Paytm employees including his long-time secretary Sonia Dhawan.

Debjani Ghosh

After leading chipmaker Intel Corp’s operations in Asia for nearly a decade, Debjani Ghosh took charge as Nasscom president in April this year. Ghosh is the first woman to become Nasscom’s president in the two decades that the powerful lobby for India’s information technology (IT) sector has been in existence.

Gender diversity has been a key issue in the IT sector lately and it is widely expected that with Ghosh at the helm, the lobby will be able to address the issue more effectively.

Pankaj Chaddah, Abhijit Bose

It is rare for founders in India’s startup ecosystem to move on to newer pastures before their companies have marked a significant milestone such as an acquisition or an IPO. But in 2018, two founders did just that.

In March, Zomato’s Pankaj Chaddah decided to leave the food-tech company he co-founded a decade ago and is expected to start a new venture. He remains on the Zomato board.

In November, in a surprise move, Abhijit Bose, founder and CEO of mobile payments startup Ezetap, was appointed as the head of messaging app WhatsApp’s India operations. He continues to be a shareholder in Ezetap and will remain on the board as a non-executive director.

Ajit Mohan

Former Hotstar CEO Ajit Mohan was appointed as the India managing director for social networking giant Facebook in September this year. He will formally take charge in early-2019. His appointment brought to an end a seven-month hiring process, a period that saw Facebook struggle to find a head for its India operations on account of its deteriorating relations with the government.

The company has been wracked by problems related to data privacy concerns, which delayed the launch of a payments service on its WhatsApp platform. Earlier, it fell foul of the government over its Free Basics initiative. Mohan has a tough run ahead of him when he gets on board next year.

Ritesh Agarwal

In September, 24-year-old Ritesh Agrawal’s OYO, the budget stays aggregator which now dubs itself a budget hotel chain, became the newest entrant into the coveted global unicorns club. Privately-held technology companies that are valued at $1 billion or more are called unicorns.

The company said that it was closing a $1 billion investment round led by SoftBank Vision Fund which would bump up its post-money valuation from the $850 million it fetched in its last funding round to a mind-boggling $5 billion. That’s more than the combined value of all publicly-listed Indian hotel chains including the Taj Group, the Oberoi Group and Lemon Tree Hotels.

Harsh Jain, Bhavit Sheth

Up until September this year, Harsh Jain and Bhavit Sheth mostly stayed under the radar while they went about building their Mumbai-based fantasy gaming startup Dream11. But all that changed with they picked up $100 million in a funding round led by China’s Tencent Holdings Ltd.

The deal put India’s digital gaming industry on the map -- Tencent is China’s biggest gaming and social media company -- and is expected to breathe new life into the gaming sector which has struggled through the years to find scale and attract significant investor interest.

Farid Ahsan, Bhanu Pratap Singh, Ankush Sachdeva

About four years ago, when Indian Institute of Technology-Kanpur graduates Farid Ahsan, Bhanu Pratap Singh and Ankush Sachdeva created ShareChat, a social networking platform based on native Indian languages, it was an unconventional move. After all, not many entrepreneurs, not just in India, would think of taking on social networking giant Facebook.

Their bet on native language content paid off big time this year when Chinese venture capital firm Shunwei Capital led a $100 million funding round in the company, catapulting it into the big league of consumer internet startups in India. The deal, importantly, puts businesses based on native languages in the spotlight and opens up a whole new market opportunity for both investors and entrepreneurs.

Kalyan Krishnamurthy

For the past couple of years, former Tiger Global executive Kalyan Krishnamurthy has been the quiet force behind Flipkart’s efforts to hold its ground against Amazon in India’s e-commerce market. Walmart’s acquisition of the Bengaluru-based e-commerce company has put Krishnamurthy, who is believed to have played a key role in the acquisition itself, firmly in the driver’s seat.

With both Flipkart’s founders, Sachin Bansal and Binny Bansal, having departed, Krishnamurthy is going to be the man to watch as Walmart scripts its e-commerce play in India.

The Chinese dragon

The Chinese wave of investments in India’s technology startup market has been a few years in the making and finally made a mark this year. According to VCCEdge data, Chinese investors made more than $1.5 billion worth of investments in India this year against $732.48 million in 2017. Alibaba, Tencent, and Shunwei Capital were among the big movers this year and their interest in this market continues to grow.